- Celebrating the Impersonation Rule that helps the FTC fight scamsby jensor on April 7, 2025 at 11:54 am

Celebrating the Impersonation Rule that helps the FTC fight scams jensor April 7, 2025 | 7:54AM Celebrating the Impersonation Rule that helps the FTC fight scams By BCP Staff They say April showers bring May flowers. April also marks the one-year anniversary of the FTC’s Impersonation Rule, which gives the FTC more tools to fight impersonation scams that cost nearly $3 billion in reported losses during 2024. Impersonation scams hurt people and legitimate businesses. Here’s what the FTC is doing to fight these scams.Impersonators pretend to be someone they’re not to try to steal your money or personal information. Scammers might pose as a government entity or official and say you owe a fine or a toll. Or they may claim they’re from a well-known utility company, bank, or delivery services and say there’s something wrong with your account or package. Sometimes, they pretend to be from a known company offering tech support and ask you to call quickly to fix a problem or virus on your computer. These scams hurt the reputation of legitimate businesses and cause enormous financial harm to individuals. Year after year, impersonation scams are one of the top frauds reported to the FTC. In 2024, the FTC received nearly 850,000 reports of imposter scams. The Impersonation Rule gives the FTC more tools to fight these scams. Since the Rule went into effect, the FTC has filed multiple lawsuits against alleged impersonators, including phantom debt collectors and a scheme pretending to be affiliated with the Department of Education. The FTC has halted scammers that impersonated the FTC online — successfully asking domain registrars to shut down more than a dozen scam sites. These scam sites, for example, trick people who thought they were reporting fraud to the FTC into sending money or personal information to scammers.FTC staff has also sent letters to several operators of websites that sell IRS Employer Identification Number (“EIN”) filing services discussing conduct that may violate the FTC Act and the Impersonation Rule, such as making their websites look similar to the IRS’s tool for obtaining EINs for free.Here’s advice to help your employees and customers steer clear of impersonation scams:Don’t give money or personal information to someone who contacts you unexpectedly. If you’re not sure if a call or message is real, reach out to the business, organization, or person using contact information you looked up yourself and know to be true.Don’t trust your caller ID. Your caller ID might show the name of a government agency or business, but caller ID can be faked. It could be anyone calling from anywhere in the world.Don’t click on links in unexpected emails, texts, or social media messages. Scammers send emails and messages that look like they’re from a government agency or business, but they’re really designed to steal your money and personal information.Learn more about impersonation scams at ftc.gov/impersonators. And if you spot an impersonator, tell the FTC at ReportFraud.ftc.gov.

- Data Spotlight reveals what’s behind some of those social media adsby lfair on October 5, 2023 at 1:34 pm

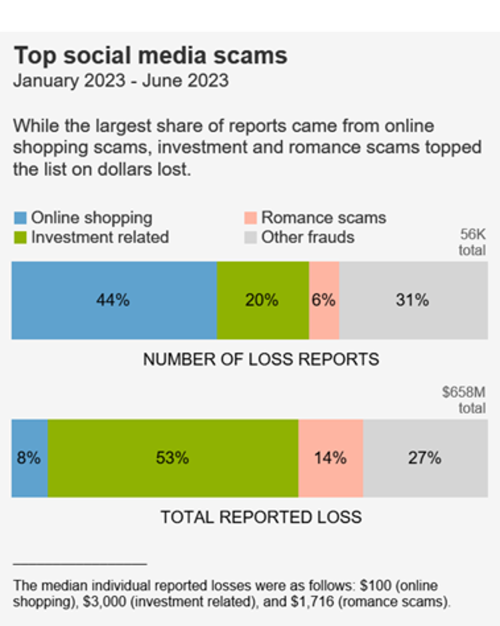

Data Spotlight reveals what’s behind some of those social media ads lfair October 5, 2023 | 9:34AM Data Spotlight reveals what’s behind some of those social media ads By Lesley Fair Sometimes being the “Home of . . .” is an honorific to be proud of. Kudos, Cleveland, for rock ‘n’ roll, and thank you, Buffalo, for your contribution to chicken wings. But the Birthplace of Frauds and Scams isn’t a nickname to be envied. According to an FTC Data Spotlight, reports from consumers suggest that in many instances, that’s becoming a moniker for social media.The Data Spotlight reveals that the most frequently reported losses to fraud in social media in the first half of 2023 were from people who tried to buy something. Many of those scams started with an ad on Facebook or Instagram. Consumers recounted stories of undelivered merchandise and lost money – no-show clothes and electronics topped the list – but that’s not the only way that scammers are using social media to sting people. Image In the first half of 2023, more than 50% of the money consumers reported losing to fraud in social media went to investment scammers. A typical modus operandi may involve money-making promotions for purported investment opportunities, often using cryptocurrency as the hook. Scammers lure people to websites or apps with their own supposed “success stories,” but consumers ultimately end up empty-handed and with empty wallets.According to the Data Spotlight, romance scams are another source of major financial losses facilitated through social media. In the first six months of 2023, half of the people who reported losing money to an online romance scam said it began through Facebook, Instagram, or Snapchat.The FTC has advice your can share with colleagues, friends, and family.Limit who can see your posts and information on social media. All platforms collect information about you from your social media activities, but visit your privacy settings to set some restrictions.Did you get a message from a friend claiming they need money ASAP or they have a can’t-miss investment opportunity to share? There’s a good chance their account has been hacked. If they ask you to pay with cryptocurrency, a gift card, or a wire transfer, it’s a solid bet a scammer is behind the message, not someone you know.Of course, every now and then you hear about a great love story that began online. But we need to talk more about the tales that don’t end so happily. The FTC has advice on how to spot a romance scam.Why should businesses care about scammers’ use of social media advertising? Because no reputable retailer wants its marketing messages tarnished by the proximity to fraud. If you spot a scam or a questionable business practice, report it to the FTC at ReportFraud.ftc.gov.

- How readiness can help protect veteran-owned businessesby lfair on November 10, 2022 at 2:56 pm

How readiness can help protect veteran-owned businesses lfair November 10, 2022 | 9:56AM How readiness can help protect veteran-owned businesses By Lesley Fair Army brats like me grew up around the word “readiness.” We knew it meant weeks or even months of a parent away on deployment, training for “What if . . .” scenarios. One of the reasons so many veterans have made the successful transition to entrepreneurship is that they continue to put readiness first. A recent FTC proposed settlement serves as a reminder to veterans who own businesses – and to all business executives – about the ongoing threats to sensitive customer and employee information posed by phishing. The best defense: readiness. Phishing scammers typically contact employees via email, text, or telephone and induce them to click a link, download a file, or reveal confidential information. Their goal is to install malware or otherwise gain access to your digital assets. In that recent case, the FTC alleged that an educational technology company’s lax security practices resulted in multiple data breaches, leading to the misappropriation of personal information about millions of consumers. One interesting aspect of the case is the allegation that the data thieves went through the digital front door by getting employees – including some senior executives – to take the bait on phishing scams. The complaint further charged that for a long stretch of time, the company “did not require employees to complete any data security training, including identifying and appropriately responding to phishing attacks.” Phishing has been around for years – the FTC’s first phishing-related case was in 2004 – but the disturbing news is that both old-school methods and more sophisticated attacks continue to succeed. The FTC has steps you can take to help protect your company from phishing fraud. Implement company-wide training. If a person is on your roster in any capacity, add them to your data security training list. In the FTC’s experience, scammers view everyone as potential targets – including interns, seasonal temps, contractors, and even people who don’t routinely use sensitive data. Furthermore, no one is too important for training. As the FTC’s recent case demonstrates, scammers don’t stop at the C Suite door and training shouldn’t either. Schedule regular refreshers. Training isn’t a one-and-done box to check off your TO DO list. Your business operations probably change with some frequency and so do the threats you must defend against. But we’ve all had to sit through in-house lectures that call to mind the “Whaa Whaa Whaa” sound effect when grown-ups talk on the “Peanuts” specials. The key is to keep the content fresh and engaging with IRL stories, headline news, and other attention grabbers. Look for tell-tale signs of phishing. There’s no 100% accurate test to tell if a message is a phishing scam, but certain characteristics can be a tip-off – for example, misspellings or grammar mistakes; demands for gift cards, wire transfers, or cryptocurrency; directions to click links or download attachments; or wording that sounds just plain weird. (One email we received recently: “It is utmost essential for all laborers to under take following manditory steps.”) Commend employees for developing a skeptical eye. “Is that really a message from the boss telling me to wire money or send a confidential spreadsheet?” “The caller said they were from Tech Support, but is that true?” “The email says it’s a link to our new company communications platform. Should I should click on it?” Encourage your staff to take a moment to think through unexpected emails, texts, or calls. Even if it turns out to be a genuine request, if their gut suggests that phishing could be afoot, applaud employees who take the time to investigate. Keep your defenses up during remote work. Double-checking was easier when it was a matter of walking down the hall to see if a request was on the level. But that’s not possible with remote workers or business travelers. Encourage your team to pick up the phone and call a number they know to be legitimate to determine if a message is a bona fide business communication or a phishing attempt. Our best advice for veterans who own businesses borrows a watchword from the United States Coast Guard: Semper Paratus (Always Ready). Anticipate threats to sensitive data in your possession and train your employees on how to spot scammers trying to infiltrate your defenses. The FTC’s Cybersecurity for Small Business resources include a segment on protecting your company from phishing scams. For information about personal financial readiness and other topics compiled especially for veterans and servicemembers, visit our Military Consumer site. This Veterans Day we’re honored to honor you – and the family members whose support was essential for your service.

- So proudly we hail: Maryland federal prosecutors honored with FTC awardby lfair on October 5, 2018 at 5:43 pm

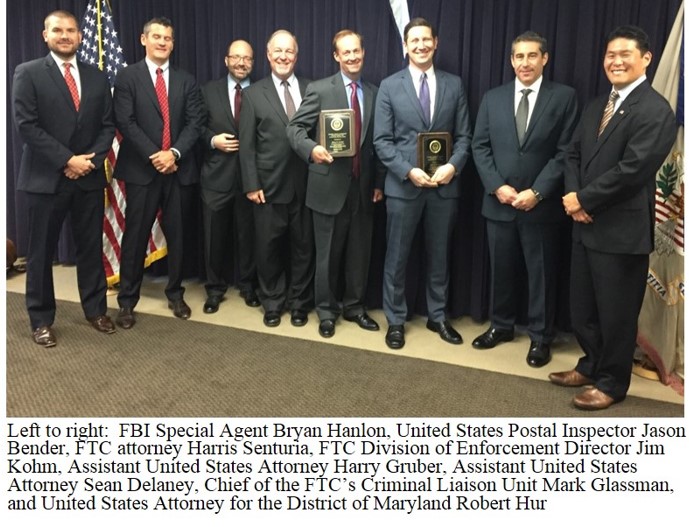

So proudly we hail: Maryland federal prosecutors honored with FTC award lfair October 5, 2018 | 1:43PM So proudly we hail: Maryland federal prosecutors honored with FTC award By Lesley Fair Laidlaw v. Organ was an 1817 Supreme Court case concerning an allegedly deceptive trade practice affecting a small business. You may be surprised to learn who argued that case and why it’s relevant 201 years later. Counsel for one of the businesses was a young Maryland attorney named Francis Scott Key. Yes, that Francis Scott Key. After the defense of Fort McHenry inspired him to pen The Star-Spangled Banner, he returned to his law practice and later became a United States Attorney. Today the FTC presented its Criminal Liaison Unit Prosecuting Attorney Award to Sean R. Delaney and Harry M. Gruber, Assistant United States Attorneys with the Office of the United States Attorney in Maryland. And if you can manage another coincidence, AUSAs Delaney and Gruber received the award for their efforts to bring to justice nine individuals charged with fraudulent practices that targeted small businesses. In this case, the defendants bilked offices, nonprofits, churches, and schools out of more than $50 million by sending them unordered supplies and then using arm-twisting tactics to demand payment. That scammy strategy should sound familiar. The FTC had previously taken action against several of the defendants and their companies in FTC v. Midway Industries. That case resulted in permanent injunctions, a $44 million judgment against one defendant, and a $58 million judgment against the rest of the lot. The FTC intends to return funds it collects to the defendants’ victims. (We also have a brochure with tips on protecting your small business from B2B scams.) With Mr. Delaney and Mr. Gruber serving as counsel, the U.S. Attorney’s Office for the District of Maryland obtained guilty pleas to multiple fraud-related crimes from nine criminal defendants involved in the scam the FTC had challenged civilly. The defendants received varying sentences, with Eric A. Epstein sentenced more than 11 years in prison. Every two years the FTC presents the Criminal Liaison Unit (CLU) Prosecuting Attorney Award to recognize prosecutors who demonstrate an exceptional commitment to consumer protection in partnership with the FTC. Since its inception in 2003, CLU has contributed to the successful criminal prosecution of hundreds of fraudulent telemarketers, phantom debt collectors, mortgage relief scammers, and others con artists who prey on American consumers. One footnote: Despite Francis Scott Key’s efforts, the Laidlaw case ultimately resulted in a remand. But thanks to Mr. Delaney and Mr. Gruber, justice prevailed in this 21st century challenge to deceptive practices targeting small business. And for that, so proudly we hail our 2018 CLU Prosecuting Attorney Award honorees.

- FTC says consumers struck out by deceptive business “coaching” pitchesby lfair on May 25, 2018 at 4:40 pm

FTC says consumers struck out by deceptive business “coaching” pitches lfair May 25, 2018 | 12:40PM FTC says consumers struck out by deceptive business “coaching” pitches By Lesley Fair Vision Solution Marketing and related defendants pitch services to prospective entrepreneurs and people looking to supplement their income. Among the defendants’ products is business “coaching” that sets people back as much as $13,995. But given the host of alleged misrepresentations cited in a lawsuit filed in federal court in Utah, the FTC says the defendants definitely aren’t playing on consumers’ team. The defendants’ telemarketing operations rely on leads supplied by other businesses in exchange for cash or a percentage of their sales. According to the FTC, the typical customer targeted by the defendants has already bought a questionable work-at-home program advertised online that also encourages buyers to contact an “expert consultant” or “specialist” to see if they qualify for an “advanced” program. Consumers are thrown another curve when the defendants then approach them about buying a business coaching program and later pitch them an additional suite of business services, like marketing plans and tax guidance. Many consumers were lured in with promises of big money. According to one of the defendants’ sales reps, the “expected range” of revenue for a new business was between $3,000 and $5,000 a month. What’s more, it’s a sure thing: “We don’t have any students we’ve built the business for that have ever failed. . . . [T]here’s literally no way to fail. As long as you have the right help, you’re going to be fine.” But the FTC says consumers who fork over their savings are left in circumstances that are anything but fine. In many cases, the pricey training the defendants offer consists primarily of basic information available for free online – like how to sell stuff on eBay. According to the lawsuit, most people who buy the defendants’ services earn next to nothing, with many ending up deep in debt. You’ll want to read the complaint for a behind-the-scenes look at the complex interrelationships that fuel operations like this. The lawsuit specifically charges that the defendants made misleading earnings claims, misrepresented the nature of their products and services, and committed multiple violations of the Telemarketing Sales Rule. In addition, the FTC alleges that the defendants tell prospective buyers they need detailed financial information to determine if the consumer qualifies for the coaching program. But according to the complaint, the defendants use those facts to figure out just how much they can charge the person for the purported coaching services. A federal judge entered stipulated Temporary Restraining Orders that freeze the defendants’ assets and prohibit them from selling business coaching services. But even at this preliminary stage, the case offers object lessons for prospective entrepreneurs or people interested in supplementing their income with a home-based business. Before shelling out for purported coaching services, consider close-to-home options that won’t cost you a penny. Approach successful business people in your community – for example, in your extended family, in local business associations, in alumni groups, or at your place of worship. Many people who have achieved success in the business world remember what it was like to be starting out and are willing to share their experience. In addition, consider free business mentoring and consulting programs offered by state offices, Small Business Development Centers affiliated with colleges in your area, and the federal Small Business Administration. (The SBA’s Local Assistance page lists programs in your community.) The FTC also has resources to help you ask the right questions before committing your cash to business opportunities or services.

- VTech settlement cautions companies to keep COPPA-covered data secureby lfair on January 8, 2018 at 5:15 pm

VTech settlement cautions companies to keep COPPA-covered data secure lfair January 8, 2018 | 12:15PM VTech settlement cautions companies to keep COPPA-covered data secure By Lesley Fair We can’t guarantee its effectiveness in getting kids to eat their vegetables or finish their homework. But there’s one circumstance in which a Mom or Dad’s “Because I said so . . . .” is the law of the land. When it comes to the online collection of personal information from kids under 13, the Children’s Online Privacy Protection Rule (COPPA) puts parents in charge. An FTC lawsuit against VTech, a big name in electronic learning products for the Swingset Set, alleges that the company violated COPPA and the FTC Act by, among other things, failing to take reasonable steps to protect sensitive data collected from children. A particular concern in this case – the FTC’s first dealing with connected toys – is the allegation that VTech’s violations came to light only after a hacker stole personal information about kids and parents who used the company’s products. First, some background. VTech operates Learning Lodge, an online platform that lets customers download child-directed apps, games, e-books, etc., onto their VTech connected devices. More than 2 million parents have created Learning Lodge accounts for close to 3 million kids. One popular app is Kid Connect, which allows children to send text messages, audio files, photos, etc., to contacts approved by Mom or Dad. Once registered, kids also can post messages on an electronic bulletin board accessible to people on the parent-OKed contact list. From at least July 2013 to November 2015, if a child wanted to use Kid Connect, a parent had to sign up on Learning Lodge. Registration required lots of personal information: the parent’s full name, physical address, email, password, and a secret Q&A for password retrieval, as well as the child’s name, date and year of birth, and gender. Parents could then set up a Kid Connect account by submitting an email address, a parent’s username and password, a child’s username, and a profile photo of both the parent and the child. (In addition, VTech offered a web-based platform called Planet VTech. It required parents to submit a substantial amount of personal information, too, including the child’s first name, login name, password, and full date of birth.) Where does the FTC allege VTech went wrong? First, VTech’s Privacy Policy said that when parents input personal information as part of the registration process for Learning Lodge, Kid Connect, or Planet VTech, “in most cases” that information “will be transmitted encrypted to protect your privacy using HTTPS encryption technology.” But according to the FTC, the data wasn’t encrypted, rendering VTech’s claim false under the FTC Act. The complaint also charges VTech with violating specific COPPA provisions. According to the FTC, VTech failed to provide sufficient notice on its website about the information it collects from children, how it uses that information, and its disclosure practices. In addition, VTech failed to provide direct notice of its policies to parents. The lawsuit also alleges that when people set up a Kid Connect account, VTech didn’t have a COPPA-compliant mechanism in place to verify that the person registering the account was a parent and not a child. Finally, Section 312.8 of the Rule requires COPPA-covered companies like VTech to “establish and maintain reasonable procedures to protect the confidentiality, security, and integrity of personal information collected from children.” However, in this case, a hacker was able to remotely access VTech’s test environment and from there gained entry into the live site. That’s where the hacker grabbed parents’ full names, addresses, email addresses, secret questions, and children’s usernames – all of which was stored in clear, readable text. Although VTech stored passwords and children’s photos and audio files in an encrypted format, a database accessed by the hacker included the decryption keys for photos and audio. What’s more, the FTC says the information was stored so that kids’ information was linked to their parents’ information. For example, that meant that if a child had submitted a photo through Kid Connect, the hacker could have found that photo, along with the child’s home address. According to the complaint, VTech didn’t know that personal information had been copied from its network until the company was contacted by a journalist. In addition to a $650,000 civil penalty, the proposed settlement includes procedures to ensure future COPPA compliance. One notable provision: a comprehensive data security program subject to independent every-other-year audits for the next 20 years. Cases are fact-specific, of course, but it’s worth taking a look at where the FTC alleges that VTech’s security practices fell short. Each of the complaint allegations points to an established security principle that COPPA-covered companies – and other businesses – should consider in evaluating their own procedures. The complaint alleges that VTech failed to develop, implement, and maintain a comprehensive information security program. If your company’s program is stashed away in a file somewhere, remember that COPPA makes security a “living” process. It could be time to revisit your program in light of changes to your business and the evolving threat landscape. The complaint alleges that VTech failed to implement adequate measures to segment and protect its live website from the test environment. That concern should sound familiar to businesses that have been following the FTC’s Start with Security and Stick with Security initiatives. Effective network segmentation could help stop an “oops” from developing into a full-blown “uh-oh.” The complaint alleges that VTech failed to have an intrusion detection system. If the burglar alarm went off at your home or workplace, you’d switch into high alert. For years now, FTC cases and guidance to businesses suggest a similar response to unauthorized network access. Careful companies have a system in place to warn them about digital trespassers. The complaint alleges that VTech failed to monitor unauthorized attempts to exfiltrate personal information. Would you know if an intruder was attempting a grab-and-go on your network? There are tools that can alert you when someone is trying to transfer large amounts of data. The complaint alleges that VTech failed to complete vulnerability and penetration testing to see how its network could stand up to well-known vulnerabilities like SQL injection. There’s no way to make a network 100% hack-proof, but as Start with Security and Stick with Security suggest, there are step you can take to protect sensitive data from oldies-but-baddies like SQL injection attacks. The complaint alleges that VTech failed to implement reasonable guidance or training for its employees. Security-conscious companies have a secret weapon in the fight to safeguard sensitive data: a well-trained workforce. Whether or not your company is covered by COPPA, have you incorporated security throughout your business? Are your employees clear on your expectations? The FTC has resources to streamline your data security and COPPA compliance efforts. Is time at a premium? Set aside a few minutes a day to watch one of our videos for businesses.

- Operation Ruse Control: 6 tips if cars are up your alleyby lfair on March 26, 2015 at 3:00 pm

Operation Ruse Control: 6 tips if cars are up your alley lfair March 26, 2015 | 11:00AM Operation Ruse Control: 6 tips if cars are up your alley By Lesley Fair When it comes to car advertising, truth should be standard equipment. That’s the message of Operation Ruse Control, a coast-to-coast and cross-border sweep by the FTC and state, federal, and international law enforcers aimed at driving out deception in automobile ads, adds-ons, financing, and auto loan modification services. The FTC cases offer 6 tips to help keep your promotions in the proper lane. 1. Avoid practices that turn add-ons into bad-ons. Two of the FTC actions involve add-ons – extra products or services tacked on to the sale, lease, or financing of a car. Typical add-ons include extended warranties, guaranteed automobile protection (GAP) insurance, credit life insurance, undercoating, and the like. According to the FTC, California-based National Payment Network deceptively claimed in online ads and through a network of authorized dealers that car buyers who bought its biweekly payment program would save money. What consumers weren’t told was that the cost of the add-on often outstripped any savings. The FTC says that was a material fact that should have been disclosed upfront. In a related action, the FTC sued New Jersey dealerships Matt Blatt Inc. and Glassboro Imports LLC for pitching NPN’s deceptive add-ons and pocketing hefty commissions. To settle the case, NPN will provide consumers with $2.475 million in refunds and fee waivers. The dealerships will turn over an additional $184,000. 2. Don’t low-ball your pitch. Three of the Operation Ruse Control cases challenge allegedly deceptive advertising by auto dealers. Some crossed the line by using headlines to tout bargain prices while failing to disclose – or failing to adequately disclose – the true cost of the deal. For example, ads for Cory Fairbanks Mazda of Longwood, Florida, pitched “used cars as low as $99.” But according to the FTC, $99 was just the minimum bid for cars offered at a liquidation sale and that didn’t include substantial mandatory fees. In a similar vein, the FTC says the dealership’s ads included photos of loaded cars without clearly explaining that some pictured features – like spoilers and sunroofs – weren’t included in the price. 3. Steer clear of deceptive “zero sum” games. Just as Seinfeld billed itself as a show about nothing, ads for Ross Nissan of El Monte focused on nothing, too – as in “$0 INITIAL PAYMENT, $0 DOWN PAYMENT, $0 DRIVE-OFF LEASE.” The California company made the same claims in Spanish language ads. Other ads promised “$0 down*, 0% APR financing*, 0 payments*, and 0 problems.” Well, the FTC had a problem with – among other things – the deceptive use of “zero.” The dealership’s “$0 at lease inception” deal wasn’t applicable if consumers wanted the cars in the ads for the advertised monthly payment. What about “$0 down payment?” The FTC says people, in fact, had to pay a down payment to finance the vehicles for the monthly payment featured in the ads. And “0% APR?” The annual percentage rate for financing those cars for the advertised payment was way more than 0%. (The complaint against Cory Fairbanks Mazda made similar allegations about deceptive “zero” claims.) The message for dealers: Don’t lure customers in with misleading “zero” promises. 4. If strings are attached, make them clear to consumers upfront. That’s the message of the FTC’s settlement with Jim Burke Nissan in Birmingham, Alabama. According to the complaint, the dealership highlighted eye-catching prices without clearly explaining what the vehicle would really cost consumers. For example, in some cases, what appeared to be the full price was actually what people would have to pay after they ponied up a down payment of as much as $3,000. Other ads featured prices that factored in special discounts or rebates that weren’t available to everyone. For example, some prices applied only to recent college grads, a restriction not prominently disclosed. The ads didn’t tell prospective buyers without a freshly-inked sheepskin that they’d have to pay more. (The Cory Fairbanks complaint includes a similar charge that the company didn’t clearly explain that the advertised discount or price had qualifications – for example, that it was available only to prior Mazda owners.) What can other dealers take from the cases? Clearly disclose material restrictions and limitations. 5. Fineprint footnotes and buried “disclaimers” are non-starters. The FTC says ads for Jim Burke Nissan, Ross Nissan of El Monte, and Cory Fairbanks Mazda all included variations on a deceptive theme: fineprint footnotes, unclear “disclaimers” that consumers had to scroll down to see, or other buried information that didn’t meet the agency’s “clear and conspicuous” standard. Advertisers often ask how big a disclosure has to be, but it’s more than a matter of font size. A clear and conspicuous disclosure is one sufficient for consumers to actually notice, read, and understand it. 6. Give credit laws the credit they’re due. The actions against all three dealers allege that they violated provisions of federal credit statutes. One common pothole: using certain “triggering terms” under the Consumer Leasing Act, Truth in Lending Act, Reg Z, or Reg M without making required disclosures. For example, if you advertise monthly lease payments, that kicks in a requirement under the CLA that you disclose other facts about the transaction – like the total amount due at lease signing, whether a security deposit is required, and the number, amount, and timing of scheduled payments. Also part of Operation Ruse Control: a law enforcement action against Florida-based Regency Financial Services and CEO Ivan Levy. According to the FTC, the company charged financially-strapped consumers upfront fees to negotiate changes to their car notes, but often didn’t provide anything in return. A federal judge froze the defendants’ assets and entered a Stipulated Preliminary Injunction. Litigation continues in that case.

- Putting the brakes on deceptive auto adsby wfg-adm109 on December 12, 2014 at 5:07 pm

Putting the brakes on deceptive auto ads wfg-adm109 December 12, 2014 | 12:07PM Putting the brakes on deceptive auto ads By Lesley Fair When it comes to cars, sometimes good things come in twos: double wishbone suspension, dual overhead cams, twin torsion bars, and classic 2 + 2 muscle cars. What’s not on that list? Two lawsuits charging two auto dealers with deceptive advertising in violation of two FTC orders.In 2012, the FTC settled separate administrative cases against Billion Auto and Ramey Motors, alleging that the companies had misrepresented key financing terms in the sale of cars. The FTC just announced enforcement actions – the Billion matter is a settlement with a civil penalty of $360,000 and the Ramey case is a complaint – charging that the dealerships violated the terms of those orders.The Billion caseIn the new case against Billion, the defendants are 20 dealerships in Iowa, Montana, and South Dakota, and a family-controlled advertising company, Nichols Media. The FTC’s action focuses on ads that used various combos of fine print and fast talk to mislead consumers about major terms of the deal. For example, one TV ad prominently touted “LEASE FOR $179 MO.,” but flashed tiny type for just three seconds: What was buried in the fine print? That the only consumers eligible for the $179 lease were repeat customers who also were members of the military or veterans. What’s more, they had to come to the table with $2,000 and the first monthly payment. Given the pounding music, pop-up graphics, whistle blasts, and multiple screen wipes, the FTC says it’s unlikely consumers could have caught those crucial terms. The complaint against Billion also cites a 30-second radio ad. In a normal cadence, the announcer said, “Now drive the 2013 Nissan Altima for just 99 dollars a month or the 2013 Nissan Sentra, just 79 dollars a month.” But fasten your seatbelt because in the last few seconds of the ad, the announcer put the pedal to the metal with this motor-mouth voiceover: “Thirty-six month, 36 thousand mile lease plus first payment tax and license. 5000 down with qualified credit. See dealer for details.” Only in this rapid-fire delivery did Billion say that it was really a 3-year lease – not a sale – and consumers had to come in with $5,000 plus the first month’s payment in their pocket.The complaint charges that the Billion defendants violated the FTC order by frequently focusing on only a few attractive terms in their ads while hiding key information in fine print or fast talk. The settlement includes a permanent injunction and a $360,000 civil penalty.The Ramey caseThe defendants in the pending lawsuit are four Virginia- and West Virginia-based dealerships. The complaint cites an ad with big-print visuals and voiceover that said, “Get a new 2012 Toyota Tundra for $27,989 or $389 per month.” But what did the fineprint say on the bottom of the screen?STK#2k1277. PRICES INCLUDED ALL MANUFACTURER REBATES AND INCENTIVES. PAYMENTS WITH $2,000 DOWN AND APPROVED CREDIT. TAX, TITLE LICENSE AND $175 PROCESSING FEE NOT INCLUDED. 75 MONTHS @ 3.99% APR. ENDS 7/31.According to the FTC, by emphasizing the purchase price and monthly payment, the defendants represented that those amounts were inclusive of all material costs and terms of the transaction. The lawsuit alleges the defendants didn’t clearly disclose the hefty down-payment.Another Ramey ad highlighted a new 2013 GMC Sierra X Cab 4 x 4 for $411 a month. According to the complaint, only in the flash of fine print did the company “disclose” that to get that deal, a buyer had to trade in a 1999 or newer Chevrolet or GMC truck.The complaint also cites numerous TV and online ads for consumer credit that the FTC says didn’t make the clear and conspicuous disclosures required by law. One doozy, alleges the FTC, buried key credit terms in an eleven-line block of rotating text that flashed on the screen for just two seconds.The lawsuit against the Ramey defendants charges that they misrepresented the costs of financing or leasing a vehicle by concealing important terms of the offer and failed to make credit disclosures clearly and conspicuously, as required by the 2012 administrative order and the Truth in Lending Act. In addition, the FTC alleges that the auto dealer group failed to retain and produce appropriate records to substantiate its offers. The FTC is asking a federal court in West Virginia to impose civil penalties.

- Less than meets the eye?by wfg-adm109 on January 23, 2014 at 5:32 pm

Less than meets the eye? wfg-adm109 January 23, 2014 | 12:32PM Less than meets the eye? By Lesley Fair When an ad purports to show a “right before your eyes” demonstration of a product in action, the visual must be a truthful representation of what it can do. If that’s not the case, both the advertiser and the ad agency can find themselves in law enforcement quicksand. That may have been news to Don Draper and his colleagues at Sterling Cooper in the early 60s, but it’s been a well-established legal tenet since then. The FTC’s complaint against Nissan North America and its ad agency, TBWA Worldwide, challenges an allegedly deceptive depiction of a Nissan Frontier’s ability to push a dune buggy up a steep incline. When it comes to demonstrations that misrepresent how a product will perform, the law draws a line in the sand that savvy advertisers would be wary of crossing. The ad in question was an eye-popper. A dune buggy struggled to conquer a sand dune worthy of Lawrence of Arabia. A male onlooker – with apologies to “Big Lebowski” fans, let’s call him The Dude – stood in the foreground. As the dune buggy spun its wheels, The Dude yelled to the driver, “Gun it, bro.” Gun it bro did, but to no avail. Then out of nowhere, a Nissan Frontier appeared. Not only did the pickup scale the steep hill with ease, but it pushed the stuck buggy up the dune, too. The ad ended with a narrator saying “The mid-size Nissan Frontier with full-size horsepower and torque. Innovation for doers, innovation for all.” According to the FTC, the ad had the look of a YouTube-type video captured by a smartphone. The audio picked up background chatter from amazed off-camera observers: “What’s this guy doing?” “Whoa, man. No way.” “Go! Go! Go!” “Are you kidding?” “Did you guys see that?” “Maniac!” Notwithstanding the astonishment of The Dude and his bros, here’s what the FTC says really happened. First, both the truck and the buggy were dragged up the dune with cables. In addition, the dune was made to appear much steeper than it was through the use of camera tricks. According to the FTC’s complaint, it was a false representation because – we hate to break The Dude’s heart – the Nissan Frontier pickup can’t perform the feat shown in the ad. FTC law banning the use of deceptive demonstrations dates back to a 1961 decision upheld by the Supreme Court. In that case, the commercial appeared to show a razor easily shaving sandpaper that had been softened with the advertiser’s shaving cream – except that the shaving cream wasn’t capable of softening sandpaper as shown. (The “sandpaper” actually turned out to be a sheet of plexiglass sprinkled with sand.) This meant that the company’s purported “demonstration” of how the shaving cream would soften a rough beard was deceptive because it misleadingly depicted how the product would perform. The FTC’s settlement with Nissan reflects that same legal principle. Here’s another point for advertisers to ponder. In the first three seconds of the Nissan ad, the phrase “Fictionalization. Do not attempt.” appeared on the screen. Clearly, the FTC didn’t think that was effective to undo the misimpression that people were watching a real Nissan pickup in action. Of course, the effectiveness of disclosures is a fact-specific analysis, but it shouldn’t surprise experienced marketers that a fleeting superscript in white letters against a sand dune didn’t meet the FTC’s “clear and conspicuous” standard. While we’re on the subject, leading off with the six-syllable word “fictionalization” – the meaning of which wasn’t entirely clear in this context – probably isn’t the most effective way to convey the message to consumers. And just what does “fictionalization” mean to consumers in this context? Does it suggest an utterly imaginary flight of fancy or something more akin to a “Law and Order” episode that changes the names, but dramatizes real events? Another noteworthy aspect of the case: The FTC’s also filed suit against Nissan’s ad agency, TBWA. Headquartered on Madison Avenue (natch), TBWA is one of the biggest names in the business. The complaint charges that the agency knew or should have known that the claims conveyed in the ad were false or misleading. (Unlike advertisers who are strictly liable for misrepresentations, the legal standard for ad agencies is “knew or should have known.”) The proposed settlement forbids Nissan from misrepresenting any feature of its pickups through a test, experiment, or demonstration. The order against TBWA bans similar misrepresentations for any pickup. File public comments online by the Feburary 24, 2014, deadline. Does this case suggest there’s a legal problem with creativity in ads? Of course not. But when a visual conveys to consumers that it’s an actual demonstration of what the product can do, companies should be mindful of their obligation to substantiate their claims. Advertisers up the ante when the demonstration relates to an objective product attribute – in this case, to use the car company’s own words, “The mid-size Nissan Frontier with full-size horsepower and torque.” As the Supreme Court said in that shaving cream case, “We think it inconceivable that the ingenious advertising world will be unable, if it so desires, to conform to the Commission’s insistence that the public be not misinformed.” Who are we to disagree? Here’s another tip for advertisers and ad agencies: Given the facts of the shaving cream decision and the Nissan case, be careful with commercials involving sand.

- FTC and Colorado AG: Infomercial pitchman’s promissory promises not premised on truthby wfg-adm109 on July 31, 2013 at 4:08 pm

FTC and Colorado AG: Infomercial pitchman’s promissory promises not premised on truth wfg-adm109 July 31, 2013 | 12:08PM FTC and Colorado AG: Infomercial pitchman’s promissory promises not premised on truth By Lesley Fair According to the ubiquitous infomercials, to rake in the big bucks with Russell Dalbey’s “wealth-building” programs, all you had to do was “Find ‘Em,” “List ‘Em,” and “Make Money” — the “‘Em” being seller-financed promissory notes. The pitch was convincing to the close to one million people who bought the programs. But according to the FTC and Colorado AG, the defendants’ claims of quick and easy money were deceptive. The case just settled with a stipulated order that imposes far-reaching bans that will end Dalbey’s infomercial, telemarketing, and business opportunity days forever. People who watched a lot (or even a little) late night TV couldn’t miss Dalbey’s overhyped claims. On one infomercial — which ran tens of thousands of times — Dalbey said, “The truth is anyone can make a ton of money or even become a millionaire and you don’t need money or college or even talent to do it.” Purported users of his “system” supposedly earned “$1.2 million in 30 days,” “$79,000 in a few hours,” and “$262,216 part time.” But according to the FTC and AG, claims conveyed through testimonials were at best atypical and often were flat-out false. The deception didn’t end there. Even after people shelled out between $40 and $160 on the initial program, telemarketers pursued them to pay hundreds or even thousands more for additional stuff, like seminars, coaching sessions, and lead lists. But no matter how large the investment, the FTC says very few people made any money, let alone the kind of money Dalbey promised. The infomercials may have been called “Winning in the Cash Flow Business,” but the vast majority of Dalbey’s customers lost out. Among other things, the settlement bans Russell Dalbey and Catherine Dalbey, who also was active in the companies, for life from telemarketing, from marketing or selling business opportunities, and from producing or distributing infomercials. The Dalbeys also must disclose their assets in sworn financial statements, repatriate all foreign assets, and cooperate fully as the FTC and Colorado AG’s office determine how much of the $330 million judgment the Dalbeys can pay. Under a separate stipulated order with Russell Dalbey’s three companies — DEI, LLLP; Dalbey Education Institute, LLC; and IPME, LLLP — the companies will be liable along with the Dalbeys for the $330 million. The three companies, which ceased operations shortly after the FTC and Colorado AG’s complaint, filed Chapter 7 bankruptcy petitions in 2011. What’s the best advice for people thinking about buying a business opportunity or money-making “system”? 1. Follow the example of the best-run businesses and convene your own personal “board of directors.” Successful entrepreneurs don’t make a move without consulting trusted advisors. Before investing in a business opportunity or paying for a system or seminar, run the proposal past people in your inner circle with a track record of business know-how. 2. Consider tips from the FTC about how to spot a questionable money-making offer. Steer clear of any pitch that sounds even vaguely like one already challenged by law enforcers as deceptive.

FTC Business Blog

We are an ethical website cyber security team and we perform security assessments to protect our clients.