- False alarm, real scam: how scammers are stealing older adults’ life savingsby bjames@ftc.gov on August 4, 2025 at 12:39 pm

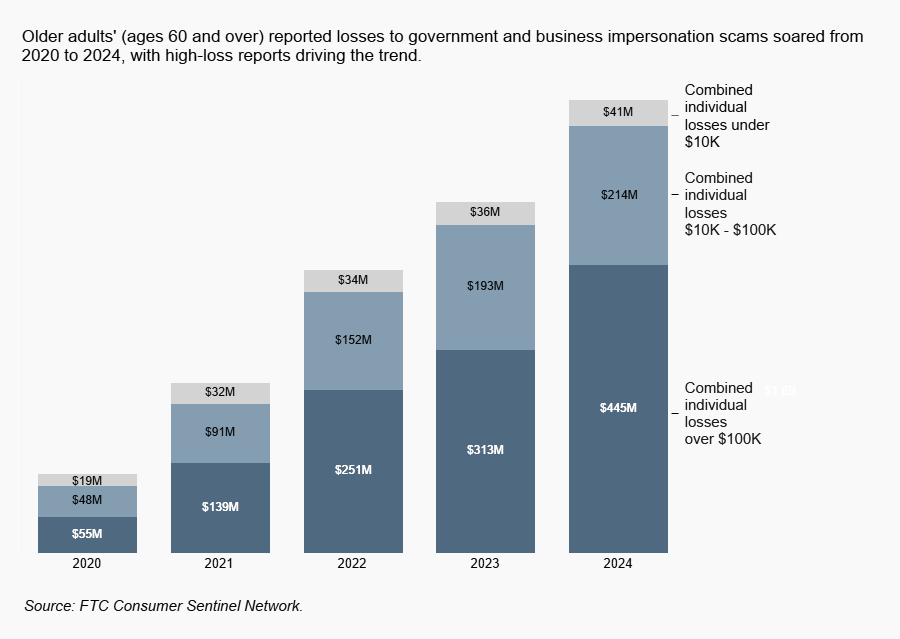

False alarm, real scam: how scammers are stealing older adults’ life savings bjames@ftc.gov August 4, 2025 | 8:39AM False alarm, real scam: how scammers are stealing older adults’ life savings By Division of Consumer Response and Operations Staff Reports to the FTC show a growing wave of scams aimed squarely at retirees’ life savings. These scammers pretend to be from known and trusted government agencies and businesses. And, in an ironic twist, recent scams use fake security alerts and other false alarms to prey on older adults’ vigilance about protecting their money and identity to steal from them.[1] Some people 60+ have reported emptying their bank accounts and even clearing out their 401ks.While younger people report losing money to these imposters too, reports of losses in the tens and hundreds of thousands of dollars are much more likely to be filed by older adults,[2] and those numbers have soared. From 2020 to 2024, the number of reports from older adults who lost $10,000 or more to these scams increased more than fourfold.[3] When older adults reported losing more than $100,000, the trend was even more striking: during the same period, the number of reports increased nearly sevenfold, and the combined reported losses went up eightfold.These high-loss scams typically start with a (fake) story that gets your attention with one or a combination of these lies:Lie #1: Someone is using your accounts. This lie might start with someone pretending to be your bank, flagging so-called suspicious activity, or pretending to be Amazon with a message about an unauthorized purchase;Lie #2: Your information is being used to commit crimes. This lie may come from a supposed government officer or agent, warning that your Social Security number is linked to a crime like drug smuggling, money laundering, or even child pornography; orLie #3: There’s a security problem with your computer. This lie often starts with a fake on-screen security alert that looks like it’s from Microsoft or Apple with a number to call. If you call, they say your online accounts have been hacked.These scammers say the only way out of the (fake) crisis is to follow their instructions – which will include sending money to the scammers. They may say this will keep your money safe, secure your identity, clear your name, or help catch the criminals. There may be layers of complexity to the story, but it’s all a lie aimed at draining your accounts. Reports show that when people think they are fixing a problem rather than sending a stranger money, their losses are often limited only by their available funds.Lots of scams are now carried out online, but these scams still depend on a phone call. Even when they don’t start with a call, reports show the goal is to get you on the phone.[4] A call is still the best way to dial up the fear and the urgency so it’s harder for you to think clearly and check things out. Keeping you on the phone is also designed to keep you from talking to anyone who could help – a friend or family member in a calmer state of mind who might see through the lies.In another layer of irony, these scammers often pretend to be the FTC, the nation’s consumer protection agency, sometimes impersonating real staff. Reports show these scammers have told people to transfer money out of their accounts, deposit cash into Bitcoin ATMs, and even hand off stacks of cash or gold to couriers[5] – all things the real FTC will never do. Scammers also pretend to be other businesses and agencies, including banks, Microsoft, and the Social Security Administration. Often, they tag team you: maybe starting with a pop-up security alert impersonating Microsoft and then transferring you to someone pretending to be from the FTC for “help” with a fake identity theft problem. Image The security of your accounts, along with the risk of identity theft, are real concerns that real companies might call you about. So how can you stay vigilant and steer clear of these scams?Don’t move money to “protect it.” Never transfer or send money to anyone, no matter who they say they are, in response to an unexpected call or message. Even if they say it’s to “protect it.”Hang up and verify. Hang up the phone and call the company or agency directly using a phone number or website you know is real. Don’t trust what an unexpected caller says, and never use the phone number in a computer security pop-up or an unexpected text or email.Block unwanted calls. Learn about your call blocking options to stop many of these scammers before they reach you.Learn more about imposter scams. To spot and avoid scams – and learn how to recover money if you paid a scammer – visit ftc.gov/scams. Report scams to the FTC at ReportFraud.ftc.gov. [1] A 2023 Gallup poll asked Americans how much they worry about various types of crime. The results showed people most often worried about being a victim of identity theft. Being tricked by a scammer into sending money or providing access to a financial account was the second highest concern. See Gallup.com, Scams: Relatively Common and Anxiety-Inducing for Americans (November 2023).[2] In 2024, losses to business imposter and government imposter scams of $10,000 and over were more than twice as likely to be reported by older adults, with losses over $100,000 three times as likely to be reported by older adults. This comparison of older and younger consumers’ reporting rates is normalized based on the population size of each age group using the Census Bureau’s 2019-2023 American Community Survey 5-Year Estimates. This excludes reports that did not include consumer age information.[3] The total number of business imposter and government imposter reports filed by older adults with a loss of $10K or more are as follows: 1,790 (2020), 3,516 (2021), 5,559 (2022), 7,091 (2023), 8,269 (2024).[4] In 2024, 41% of older adults who reported losing $10K or more to a business or government imposter scam indicated a phone call was the initial contact method, 15% indicated the scam started with an online ad or pop-up, and 13% said it started with an email. Reports indicating online ad or pop-up as the contact method typically described pop-up security alerts impersonating Microsoft or Apple with a number to call.[5] In 2024, 33% of older adults who reported losing $10K or more to a business or government imposter scam indicated cryptocurrency was the method of payment, followed by bank transfer (20%), and cash (16%). Most reports that identified cryptocurrency as the payment method mentioned Bitcoin ATMs in the report narrative. Although gold is not a payment method consumers can select, in about 5% of reports with losses of $10K or more (and about 21% of reports with losses over $100K) gold was written in as the payment method and/or mentioned in the complaint narrative. Note that when losses exceeded $100,000, bank transfer was the most frequently reported method at 32% of reports.

- Bitcoin ATMs: A payment portal for scammersby bacree on August 14, 2024 at 8:47 pm

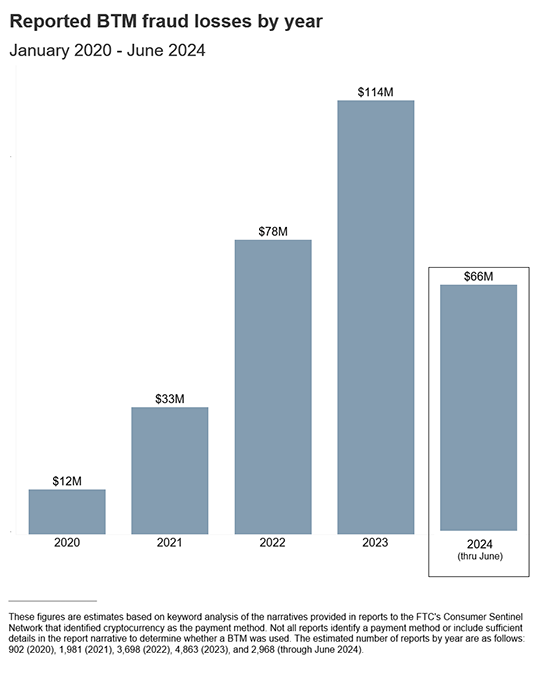

Bitcoin ATMs: A payment portal for scammers bacree August 14, 2024 | 4:47PM Bitcoin ATMs: A payment portal for scammers By Emma Fletcher Bitcoin ATMs (or BTMs)[1] have been popping up at convenience stores, gas stations, and other high-traffic areas for years.[2] For some, they’re a convenient way to buy or send crypto, but for scammers they’ve become an easy way to steal. FTC Consumer Sentinel Network data show that fraud losses at BTMs are skyrocketing, increasing nearly tenfold from 2020 to 2023, and topping $65 million in just the first half of 2024.[3] Since the vast majority of frauds are not reported, this likely reflects only a fraction of the actual harm.[4]Cryptocurrency surged as a major payment method for scams in recent years, along with the massive growth in crypto payments on fake investment opportunities.[5] But now crypto is a top payment method for many other scams, too.[6] Widespread access to BTMs has helped make this possible. Reports of losses using BTMs are overwhelmingly about government impersonation, business impersonation, and tech support scams.[7] And when people used BTMs, their reported losses are exceptionally high. In the first six months of 2024, the median loss people reported was $10,000.[8] Image In the first half of the year, people 60 and over were more than three times as likely as younger adults to report a loss using a BTM.[9] In fact, more than two of every three dollars reported lost to fraud using these machines was lost by an older adult.[10]Scams that use BTMs work in lots of different ways. Many start with a call or message about supposed suspicious activity or unauthorized charges on an account.[11] Others get your attention with a fake security warning on your computer, often impersonating a company like Microsoft or Apple. These things are hard to ignore, and that’s the point. From there, the story quickly escalates. They might say all your money is at risk, or your information has been linked to money laundering or even drug smuggling. The scammer may get a fake government agent on the line – maybe even claiming to be from the “FTC” – to up the ante.So where do BTMs fit into the story? Scammers claim that depositing cash into these machines will protect your money or fix the fake problem they’ve concocted. They’ve even called BTMs “safety lockers.” They direct you to go to your bank to take out cash. Next, they send you to a nearby BTM location – often a specific one – to deposit the cash you just took out of your bank account.[12] They text you a QR code to scan at the machine, and once you do, the cash you deposit goes right into the scammer’s wallet.So how can you spot and steer clear of these scams?Never click on links or respond directly to unexpected calls, messages, or computer pop-ups. If you think it could be legit, contact the company or agency, but look up their number or website yourself. Don’t use the one the caller or message gave you.Slow down. Scammers want to rush you, so stop and check it out. Before you do anything else, talk with someone you trust.Never withdraw cash in response to an unexpected call or message. Only scammers will tell you to do that.Don’t believe anyone who says you need to use a Bitcoin ATM, buy gift cards, or move money to protect it or fix a problem. Real businesses and government agencies will never do that – and anyone who asks is a scammer.To spot and avoid scams visit ftc.gov/scams. Report scams to the FTC at ReportFraud.ftc.gov.[1] While machines that allow consumers to buy cryptocurrency are commonly referred to as Bitcoin ATMs or BTMs, these machines often handle – and scams can take place in – other cryptocurrencies in addition to Bitcoin.[2] BTM installations self-reported by operators to an industry website increased from about 4,250 in January 2020 to about 32,000 in June 2024. See trend chart available at https://coinatmradar.com/charts/growth/united-states/[3] These and other figures throughout this Spotlight are estimates based on keyword analysis of the narratives provided in reports that identified cryptocurrency as the payment method. Not all reports identify a payment method or include sufficient details in the report narrative to determine whether a BTM was used.[4] See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323(study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).[5] See FTC Consumer Protection Data Spotlight, Reports Show Scammers Cashing in on Crypto Craze (June 3, 2022), available at https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2022/06/reports-show-scammerscashing-crypto-craze.[6] In the first half of 2024, cryptocurrency was the top payment method in terms of aggregate reported losses on tech support scams and job scams, and the second most costly method after bank transfers on business impersonation scams, government impersonation scams, romance scams, and family and friend impersonation scams.[7] In the first half of 2024, about 86% of people who reported a fraud loss using a BTM indicated that it was on a government impersonation, business impersonation, and/or tech support scam. This excludes reports categorized as unspecified.[8] In the first half of 2024, the median individual reported fraud loss when cryptocurrency was the reported payment method (including reports with and without BTM use) was $5,400; the median individual reported loss to fraud generally was $447.[9] This comparison of older and younger consumers’ reporting rates is normalized based on the population size of each age group using the Census Bureau’s 2018-2022 American Community Survey 5-Year Estimates. This excludes reports that did not include consumer age information.[10] In the first half of 2024, people 60 and over reported losing $46 million using BTMs, or about 71% of the reported losses using these machines. During the same period, when a reported cryptocurrency fraud loss did not involve the use of a BTM, about 72% of the losses were reported by people 18 to 59. Most of these losses were to fake cryptocurrency investment opportunities. Percentage calculations exclude reports that did not include consumer age information.[11] Phone calls were the initial contact method in about 47% of these reports, followed by online ads or pop-ups (16%), and e-mails (9%). Reports indicating online ad or pop-up as the contact method typically described fake computer security alerts. People reported that security pop-ups and email messages included a phone number to call for help.[12] Reports show that scammers direct people to specific BTM locations and many consumers name the BTM operator in their reports. These details show a pattern that suggests scammers prefer some operators over others and that these preferences have changed over time. While the reports do not tell us why this might be, differences in fraud prevention measures taken by various operators likely play a role.

- Social media: a golden goose for scammersby bjames@ftc.gov on October 6, 2023 at 1:30 pm

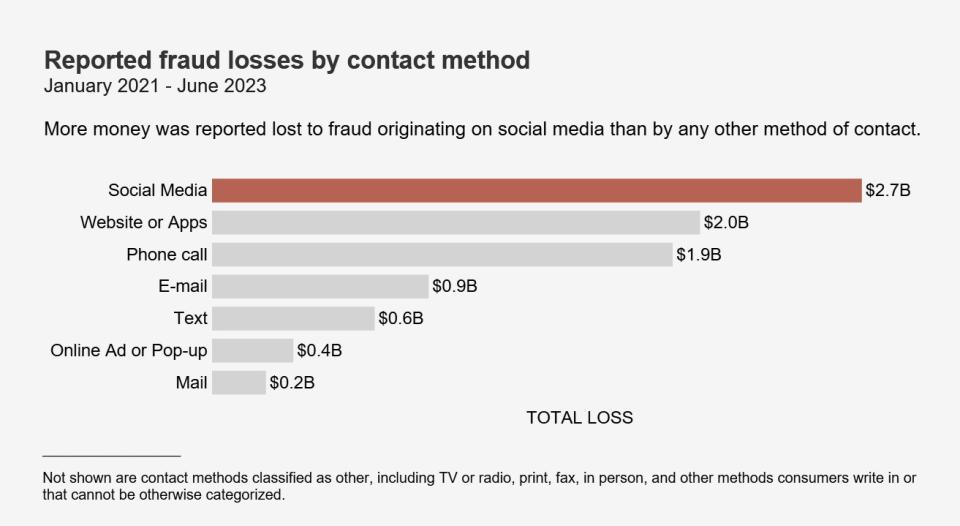

Social media: a golden goose for scammers bjames@ftc.gov October 6, 2023 | 9:30AM Social media: a golden goose for scammers By Emma Fletcher Scammers are hiding in plain sight on social media platforms and reports to the FTC’s Consumer Sentinel Network point to huge profits. One in four people who reported losing money to fraud since 2021 said it started on social media.[1] Reported losses to scams on social media during the same period hit a staggering $2.7 billion, far higher than any other method of contact. And because the vast majority of frauds are not reported, this figure reflects just a small fraction of the public harm.[2] Social media gives scammers an edge in several ways. They can easily manufacture a fake persona, or hack into your profile, pretend to be you, and con your friends. They can learn to tailor their approach from what you share on social media. And scammers who place ads can even use tools available to advertisers to methodically target you based on personal details, such as your age, interests, or past purchases. All of this costs them next to nothing to reach billions of people from anywhere in the world. Reports show that scams on social media are a problem for people of all ages, but the numbers are most striking for younger people. In the first six months of 2023, in reports of money lost to fraud by people 20-29, social media was the contact method more than 38% of the time. For people 18-19, that figure was 47%.[3] The numbers decrease with age, consistent with generational differences in social media use.[4] Image The most frequently reported fraud loss in the first half of 2023 was from people who tried to buy something marketed on social media, coming in at a whopping 44% of all social media fraud loss reports. Most of these reports are about undelivered goods, with no-show clothing and electronics topping the list.[5]According to reports, these scams most often start with an ad on Facebook or Instagram.[6] Image While online shopping scams have the highest number of reports, the largest share of dollar losses are to scams that use social media to promote fake investment opportunities.[7] In the first six months of 2023, more than half the money reported lost to fraud on social media went to investment scammers. To draw people in, these scammers promote their own supposed investment success, often trying to lure people to investment websites and apps that turn out to be bogus. They make promises of huge returns, and even make it look like an “investment” is growing. But if people invest, and reports say it’s usually in cryptocurrency,[8] they end up empty handed. After investment scams, reports point to romance scams as having the second highest losses on social media. In the first six months of 2023, half of people who said they lost money to an online romance scam said it began on Facebook, Instagram, or Snapchat.[9] These scams often start with a seemingly innocent friend request from a stranger followed by love bombing and the inevitable request for money. Here are some ways to steer clear of scams on social media: Limit who can see your posts and information on social media. All platforms collect information about you from your activities on social media, but visit your privacy settings to set some restrictions. If you get a message from a friend about an opportunity or an urgent need for money, call them. Their account may have been hacked—especially if they ask you to pay by cryptocurrency, gift card, or wire transfer. That’s how scammers ask you to pay. If someone appears on your social media and rushes you to start a friendship or romance, slow down. Read about romance scams. And never send money to someone you haven’t met in person. Before you buy, check out the company. Search online for its name plus “scam” or “complaint.” To learn more about how to spot, avoid, and report scams—and how to recover money if you’ve paid a scammer—visit ftc.gov/scams. If you spot a scam, report it to the FTC at ReportFraud.ftc.gov. [1] This figure excludes reports that did not specify a contact method. Including reports directly to the FTC and reports provided by Sentinel data contributors, 257,945 reports about money lost to fraud originating on social media were filed from January 2021 through June 2023. [2] See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity). [3] These figures exclude reports that did not specify a contact method and reports that did not include age information. [4] See Pew Research Center, Social Media Use in 2021 (April 2021), available at https://www.pewresearch.org/internet/2021/04/07/social-media-use-in-2021/ (study showed people ages 18-29 reported the highest social media use at 84%, followed by ages 30-49 at 81%, ages 50-64 at 73% and 65 and over at 45%). In the first 6 months of 2023, the share of loss reports indicating social media as the contact method by age was as follows: 47% (18-19), 38% (20-29), 32% (30-39), 28% (40-49), 26% (50-59), 21% (60-69), 15% (70-79), 9% (80 and over). Social media was the top contact method ranked by fraud loss reports for all age groups under age 70, while phone call was the top contact method for the 70-79 and 80 and over age groups. [5] The top undelivered items were identified by hand-coding a random sample of 400 reports that contained a narrative description identifying the items ordered. [6] In the first 6 months of 2023, people reported undelivered merchandise in 61% of loss reports about online shopping fraud originating on social media. Facebook was identified as the social media platform in 60% of these reports, and Instagram was identified in 24%. This excludes reports that did not identify a platform. [7] The top platforms identified in these reports were Instagram (30%), Facebook (26%), WhatsApp (13%), and Telegram (9%). Reports that did not indicate a platform are excluded from these calculations. [8] In the first 6 months of 2023, cryptocurrency was identified as the payment method in 53% of investment-related fraud reports that indicated social media as the method of contact. This excludes reports that did not specify a payment method. [9] Facebook and Instagram were each identified in 21% of these reports, followed by Snapchat at 8%. This excludes reports that did not specify the platform, website, or app.

- Who experiences scams? A story for all agesby bacree on November 9, 2022 at 1:17 pm

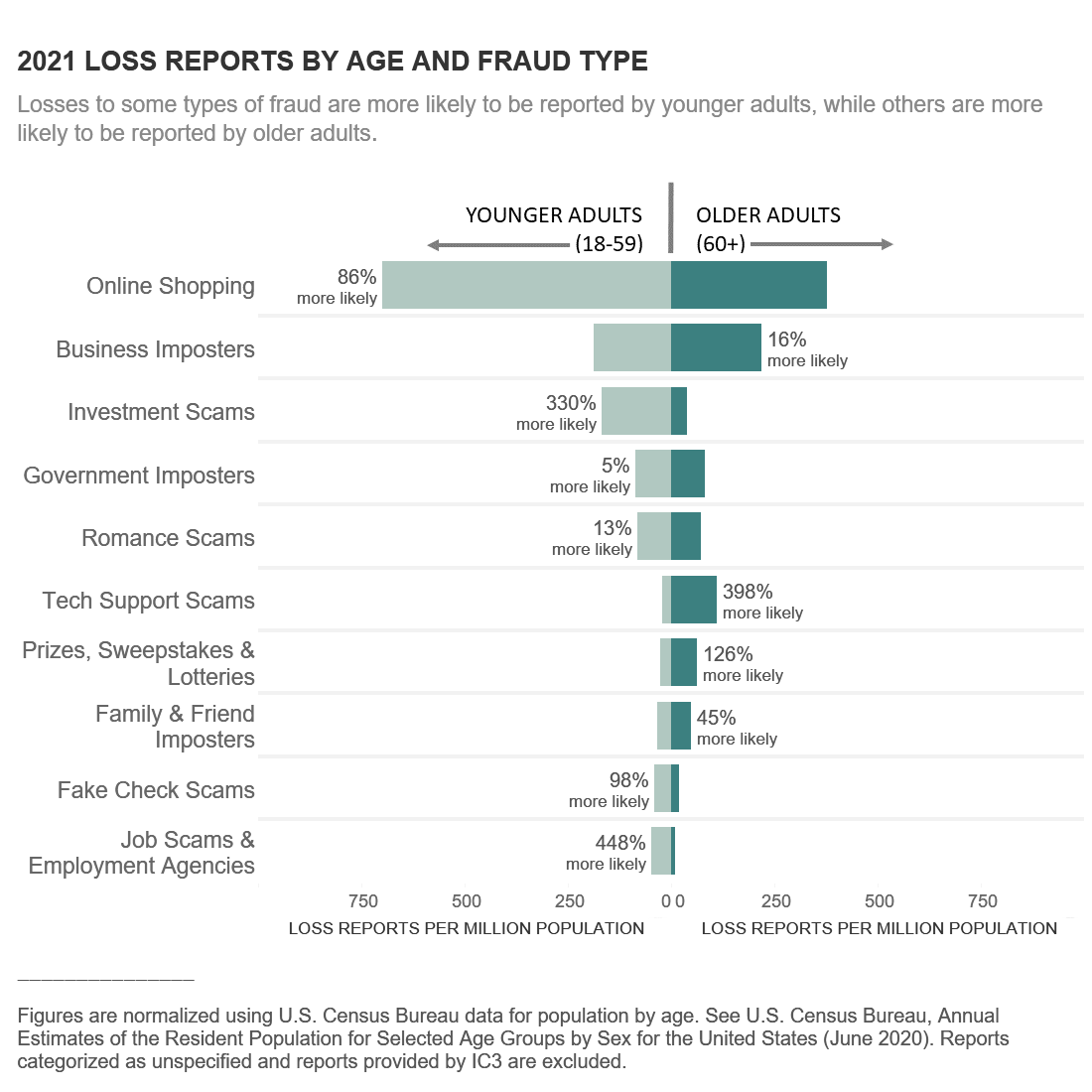

Who experiences scams? A story for all ages bacree November 9, 2022 | 8:17AM Who experiences scams? A story for all ages Many people think scams mostly affect older adults. But reports to the FTC’s Consumer Sentinel tell a different story: anyone can be scammed. In fact, reports suggest that many scams are harming younger people more than older adults. While there’s more to the story, the broad theme is that scams affect every age group, but differently. In 2021, Gen Xers, Millennials, and Gen Z young adults (ages 18-59) were 34% more likely than older adults (ages 60 and over) to report losing money to fraud,[1] and some types of fraud stood out. Younger adults reported losses to online shopping fraud – which often started with an ad on social media – far more often than any other fraud type, and most said they simply did not get the items they ordered.[2] Younger adults were over four times more likely than older adults to report a loss on an investment scam.[3] Most of these were bogus cryptocurrency investment opportunities.[4] And this age group reported losing money on job scams at more than five times the rate of older adults. Many college students reported that they were scammed after getting a message at their student email address about a so-called job opportunity.[5] The median individual reported fraud loss by people 18-59 was $500 in 2021. While older adults were less likely to report losing money to fraud, those 70 and over reported much higher median individual losses. The median reported loss was $800 for people 70-79, and a whopping $1,500 for those 80 and over.[6] But older adults were also much more likely to report fraud they had spotted or encountered – but avoided losing any money to – than people 18-59.[7] And for older adults, different types of scams stood out. In 2021, they were about five times more likely to report losing money on tech support scams than younger adults. Tech support scammers impersonate companies like Apple and Microsoft to trick you into sending money to fix an “urgent” security problem that doesn’t exist. Older adults were also more than twice as likely to report losing money on a prize, sweepstakes, or lottery scam. Prize, sweepstakes, and lottery scams often impersonate a well-known business to trick people into sending money to claim nonexistent winnings. Reports point to these scams as especially costly to people 80 and over – about one out of every three dollars reported lost to fraud by this age group in 2021 was lost to a prize, sweepstakes, and lottery scam.[8] Reports also point to generational differences in how scammers reach people. On social media, the differences are striking: in 2021, 31% of people 18-59 who reported losing money on a scam said it started on a social media platform; compare that to 15% of people 60 and older. For Gen Z young adults and younger Millennials (ages 18-29), reports suggest social media plays an even larger role – nearly 40% of 2021 fraud loss reports by this age group were to frauds originating on social media. Scams that start with a phone call also show big age differences: in 2021, 24% of older adults who reported losing money to a scam said it started with a phone call, compared to just 10% of younger consumers. The numbers are higher still for people 80 and over – more than 40% of their 2021 loss reports identified a phone call as the contact method.[9] The lesson is clear: no matter your age, learning about scams is important for everyone. By sharing what you know, you can help protect others in your community from scams. To learn more, visit ftc.gov/PassitOn. And for a deeper dive into the FTC’s data on scams and age, read the FTC’s Protecting Older Consumers Report. [1] This comparison of older adults and younger adults is normalized against the population size of each age group. The analysis is based on U.S. Census Bureau data for population by age. See U.S. Census Bureau, Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020), available at https://www.census.gov/data/tables/time-series/demo/popest/2010s-national-detail.html. Data provided by the Internet Crimes Complaint Center (IC3) are excluded here and throughout this Spotlight due to differences in the age ranges collected from consumers and differences in report categorization. About 46% of fraud reports filed in 2021 included consumer age information. [2] In 2021, 59% of online shopping loss reports by people 18-59 indicated that the order was never received. Excluding reports that did not specify a contact method, 38% of these consumers indicated that the fraud started with an ad, a post, or a message on social media. [3] Investment scams refer to fraud reports classified as investment seminars and advice, stocks and commodity futures trading, art, gems and rare coin investments, and miscellaneous investments. [4] In 2021, 62% of investment scams loss reports by people 18-59 indicated cryptocurrency as the payment method, compared to 37% of investment scam loss reports by people 60 and older. These figures exclude reports that did not indicate a payment method. [5] Job scams often use fake checks to trick people into sending money. People 18-59 were nearly twice as likely as older adults to report a loss on a fake check scam in 2021, and many of these reports were also classified as job scams. [6] People 60-69 reported a median individual loss of $520 in 2021. [7] In 2021, controlling for population size (see footnote 1), people 60 and older were 68% more likely than people 18-59 to file a fraud report indicating no money was lost. The largest share of 2021 no-loss reports by older adults were about phone scams, and these were most often calls from scammers impersonating businesses and government agencies. [8] In 2021, $47 million of the $151 million reported lost to fraud by people 80 and over was lost to prize, sweepstakes, and lottery scams, more than any other age group. [9] In 2021, excluding reports that did not indicate a contact method, 41% of loss reports by people 80 and over indicated phone as the contact method, compared to 22% of loss reports by people 60-79. Excluding reports that did not indicate a contact method, 53% of 2021 aggregate reported loss by adults 80 and over were on scams that started with a phone call, compared to 26% of aggregate reported losses by people 60-79.

- Social media a gold mine for scammers in 2021by bacree on January 25, 2022 at 2:36 pm

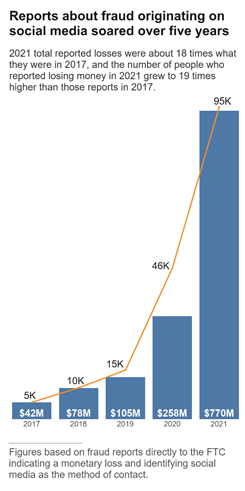

Social media a gold mine for scammers in 2021 bacree January 25, 2022 | 9:36AM Social media a gold mine for scammers in 2021 By Emma Fletcher Social media permeates the lives of many people – we use it to stay in touch, make new friends, shop, and have fun. But reports to the FTC show that social media is also increasingly where scammers go to con us. More than one in four people who reported losing money to fraud in 2021 said it started on social media with an ad, a post, or a message.[1] In fact, the data suggest that social media was far more profitable to scammers in 2021 than any other method of reaching people.[2]More than 95,000 people reported about $770 million in losses to fraud initiated on social media platforms in 2021.[3] Those losses account for about 25% of all reported losses to fraud in 2021 and represent a stunning eighteenfold increase over 2017 reported losses. Reports are up for every age group, but people 18 to 39 were more than twice as likely as older adults to report losing money to these scams in 2021.[4]For scammers, there’s a lot to like about social media. It’s a low-cost way to reach billions of people from anywhere in the world. It’s easy to manufacture a fake persona, or scammers can hack into an existing profile to get “friends” to con. There’s the ability to fine-tune their approach by studying the personal details people share on social media. In fact, scammers could easily use the tools available to advertisers on social media platforms to systematically target people with bogus ads based on personal details such as their age, interests, or past purchases.Reports make clear that social media is a tool for scammers in investment scams, particularly those involving bogus cryptocurrency investments — an area that has seen a massive surge in reports.[5] More than half of people who reported losses to investment scams in 2021 said the scam started on social media.[6] Reports to the FTC show scammers use social media platforms to promote bogus investment opportunities, and even to connect with people directly as supposed friends to encourage them to invest. People send money, often cryptocurrency, on promises of huge returns, but end up empty handed.[7]After investment scams, FTC data point to romance scams as the second most profitable fraud on social media. Losses to romance scams have climbed to record highs in recent years. More than a third of people who said they lost money to an online romance scam in 2021 said it began on Facebook or Instagram.[8] These scams often start with a seemingly innocent friend request from a stranger, followed by sweet talk, and then, inevitably, a request for money.[9]While investment and romance scams top the list on dollars lost, the largest number of reports came from people who said they were scammed trying to buy something they saw marketed on social media. [10] In fact, 45% of reports of money lost to social media scams in 2021 were about online shopping. In nearly 70% of these reports, people said they placed an order, usually after seeing an ad, but never got the merchandise. Some reports even described ads that impersonated real online retailers that drove people to lookalike websites. When people identified a specific social media platform in their reports of undelivered goods, nearly 9 out of 10 named Facebook or Instagram.[11]Together, investment scams, romance scams, and online shopping fraud accounted for over 70% of reported losses to social media scams in 2021. But there are many other frauds on social media too, and new ones popping up all the time. Here are some ways to help you and your family stay safe on social media:Limit who can see your posts and information on social media. All platforms collect information about you from your activities on social media, but visit your privacy settings to set some restrictions.Check if you can opt out of targeted advertising. Some platforms let you do that.If you get a message from a friend about an opportunity or an urgent need for money, call them. Their account may have been hacked – especially if they ask you to pay by cryptocurrency, gift card, or wire transfer. That’s how scammers ask you to pay.If someone appears on your social media and rushes you to start a friendship or romance, slow down. Read about romance scams. And never send money to someone you haven’t met in person.Before you buy, check out the company. Search online for its name plus “scam” or “complaint.”To learn more about how to spot, avoid, and report scams—and how to recover money if you’ve paid a scammer—visit ftc.gov/scams. If you spot a scam, report it to the FTC at ReportFraud.ftc.gov. [1] Excluding reports that did not specify a method of contact, 27% (94,541) of 349,177 2021 fraud reports to the FTC’s Consumer Sentinel Network indicating a dollar loss identified social media as the contact method. Reports provided by data contributors are excluded here and throughout this Spotlight because of differences in the collection of contact method information. This method of identifying reports indicating social media as the contact method differs from the method used in an October 2020 Data Spotlight titled “Scams Starting on Social Media Proliferate in Early 2020” because of enhancements to FTC’s collection of contact method information beginning in October 2020. Both methods show a significant increase in reports about fraud initiated on social media.[2] Excluding reports that did not indicate a contact method, the total amount reported lost to frauds indicating social media as the contact method in 2021 was $770 million (26%), followed by website or app at $554 million (19%), and phone call at $546 million (18%). Note that the 2021 median individual reported losses were highest on phone fraud at $1,110 compared to $468 on frauds indicating social media as the contact method.[3] Because the vast majority of frauds are not reported to the government, these numbers reflect just a small fraction of the public harm caused by frauds originating on social media. See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).[4] In 2021, adults ages 18-39 submitted fraud loss reports indicating social media as the contact method at a rate 2.4 times higher than adults 40 and over. About 92% (87,048 reports) of 2021 fraud loss reports indicating social media as the contact method included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020).[5] See FTC Consumer Protection Data Spotlight, Cryptocurrency buzz drives record investment scam losses (May 17, 2021), available at https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2021/05/cryptocurrency-buzz-drives-record-investment-scam-losses.[6] Excluding reports that did not indicate a contact method, 54% of 2021 loss reports to fraud categorized as investment related identified social media as the contact method. The top platforms identified in these reports were Instagram (36%), Facebook (28%), WhatsApp (9%), and Telegram (7%). Reports that did not indicate a platform are excluded from these calculations. The median individual reported loss on investment related fraud originating on social media was $1,800 in 2021.[7]Excluding reports that did not indicate a payment method, cryptocurrency was indicated as the method of payment in 64% of 2021 investment related fraud reports that indicated social media as the method of contact, followed by payment app or service (13%), and bank transfer or payment at (9%).[8] This figure is based on 2021 loss reports directly to the FTC categorized as romance scams and where the consumer identified an online platform. Of these, the top platforms identified as the starting point for the scam were Facebook (23%) and Instagram (13%).[9] Excluding reports that did not indicate a payment method, the most frequently reported payment method for 2021 romance scam reports indicating social media as the method of contact were as follows: gift card or reload card (30%), cryptocurrency (18%), and payment app or service (15%). The 2021 median individual reported loss on romance scam reports indicating social media as the method of contact was $2,000.[10] Excluding reports that did not indicate a payment method, the most frequently reported payment methods for 2021 online shopping reports indicating social media as the method of contact were as follows: payment app or service (29%), debit card (28%), and credit card (24%). The 2021 median individual reported loss on online shopping reports indicating social media as the method of contact was $115.[11] Facebook was identified as the social media platform in 59% of these reports, and Instagram was identified in 27%.

- Cryptocurrency buzz drives record investment scam lossesby jwolf on May 17, 2021 at 2:29 pm

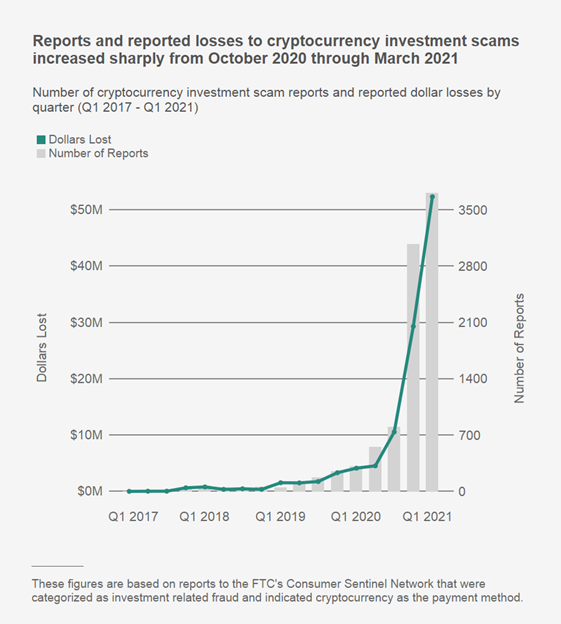

Cryptocurrency buzz drives record investment scam losses jwolf May 17, 2021 | 10:29AM Cryptocurrency buzz drives record investment scam losses By Emma Fletcher Investing in cryptocurrency means taking on risks, but getting scammed shouldn’t be one of them. Reports to the FTC’s Consumer Sentinel1 suggest scammers are cashing in on the buzz around cryptocurrency and luring people into bogus investment opportunities in record numbers. Since October 2020, reports have skyrocketed, with nearly 7,000 people reporting losses of more than $80 million on these scams.2 Their reported median loss? $1,900. Compared to the same period a year earlier, that’s about twelve times the number of reports and nearly 1,000% more in reported losses.3 Some say there’s a Wild West vibe to the crypto culture, and an element of mystery too. Cryptocurrency enthusiasts congregate online to chat about their shared passion. And with bitcoin’s value soaring in recent months, new investors may be eager to get in on the action. All of this plays right into the hands of scammers. They blend into the scene with claims that can seem plausible because cryptocurrency is unknown territory for many people. Online, people may appear to be friendly and willing to share their “tips.” But that can also be part of the ruse to get people to invest in their scheme. In fact, some of these schemes are based on referral chains, and work by bringing in people who then recruit new “investors.” Many people have reported being lured to websites that look like opportunities for investing in or mining cryptocurrencies, but are bogus. They often offer several investment tiers – the more you put in, the bigger the supposed return. Sites use fake testimonials and cryptocurrency jargon to appear credible, but promises of enormous, guaranteed returns are simply lies. These websites may even make it look like your investment is growing. But people report that, when they try to withdraw supposed profits, they are told to send even more crypto – and end up getting nothing back. Then, there are “giveaway scams,” supposedly sponsored by celebrities or other known figures in the cryptocurrency space, that promise to immediately multiply the cryptocurrency you send. But, people report that they discovered later that they’d simply sent their crypto directly to a scammer’s wallet. For example, people have reported sending more than $2 million in cryptocurrency to Elon Musk impersonators over just the past six months. Scammers even use online dating to draw people into cryptocurrency investment scams. Many people have reported believing they were in a long-distance relationship when their new love started chatting about a hot cryptocurrency opportunity, which they then acted on. About 20% of the money people reported losing through romance scams since October 2020 was sent in cryptocurrency, and many of these reports were from people who said they thought they were investing.4 Since October 2020, people ages 20 to 49 were over five times more likely to report losing money on cryptocurrency investment scams than older age groups.5 The numbers are especially striking for people in their 20s and 30s: this group reported losing far more money on investment scams than on any other type of fraud,6 and more than half of their reported investment scam losses were in cryptocurrency.7 In contrast, people 50 and older were far less likely to report losing money on cryptocurrency investment scams. But when this group did lose money on these scams, their reported individual losses were higher, with a median reported loss of $3,250. To be clear, while investment scams top the list as the most lucrative way to obtain cryptocurrency, scammers will use whatever story works to get people to send crypto. That often involves impersonating a government authority or a well-known business. For example, many people have told the FTC they loaded cash into Bitcoin ATM machines to pay imposters claiming to be from the Social Security Administration. Others reported losing money to scammers posing as Coinbase, a well-known cryptocurrency exchange. In fact, 14% of reported losses to imposters of all types are now in cryptocurrency.8 Here are some things to know to play it safe(er) when it comes to cryptocurrency: Promises of guaranteed huge returns or claims that your cryptocurrency will be multiplied are always scams. The cryptocurrency itself is the investment. You make money if you’re lucky enough to sell it for more than you paid. Period. Don’t trust people who say they know a better way. If a caller, love interest, organization, or anyone else insists on cryptocurrency, you can bet it’s a scam. To learn more about cryptocurrency scams, visit ftc.gov/cryptocurrency. If you spot a scam, report it to the FTC at ReportFraud.ftc.gov. 1 This Spotlight is based on reports from consumers to the FTC or to any Consumer Sentinel Network data contributor. 2 This figure is based on 6,792 cryptocurrency investment scam reports submitted from October 1, 2020 through March 31, 2021. Cryptocurrency investment scam reports here and throughout this Spotlight are defined as reports categorized as investment related fraud that indicate cryptocurrency as the payment method. The investment related fraud category includes the following fraud subcategories: art, gems and rare coin investments, investment seminars and advice, stocks and commodity futures trading, and miscellaneous investments. About 92% of cryptocurrency investment scam reports from October 1, 2020 through March 31, 2021 are classified as miscellaneous investments. 3 From October 1 2019 through March 31, 2020, people submitted 570 cryptocurrency investment scam reports indicating $7.5 million in total losses. 4 This figure is based reports submitted from October 1, 2020 through March 31, 2021 that were classified as romance scams. Reports that did not specify a payment method are excluded. Of these, 1,147 reports totaling $35 million in reported losses indicated cryptocurrency as the payment method. These reports are distinct from reports classified as investment related fraud, with no overlap between the two. 5 About 86% of cryptocurrency investment related fraud reports submitted from October 1, 2020 through March 31, 2021 included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020). 6 This ranking is based on a comparison of Sentinel fraud subcategories. From October 1, 2020 through March 31, 2021, consumers ages 20-39 reported $114 million in total losses on frauds classified as miscellaneous investments. Excluding unspecified reports, the subcategory with second highest reported losses by this age group was online shopping with $64 million in reported losses. These figures are not limited to reports indicating cryptocurrency as the payment method. 7 This figure is based on reports submitted from October 1, 2020 through March 31, 2021 that were categorized as investment related fraud and indicated a consumer age of range of 20 to 39. Reports that did not specify a payment method are excluded. Of these, 3,581 reports totaling $35 million in reported losses indicated cryptocurrency as the payment method. 8 This figure is based on reports from October 1, 2020 through March 31, 2021 that were categorized as imposter scams. Reports that did not specify a payment method are excluded. Of these, 3,494 reports totaling $64 million in reported losses indicated cryptocurrency as the payment method. The imposter scams category includes the following fraud subcategories: business imposters, family and friend imposters, government imposters, romance scams, and tech support scams.

- Income scams: big promises, big lossesby bcooper1 on December 10, 2020 at 8:29 pm

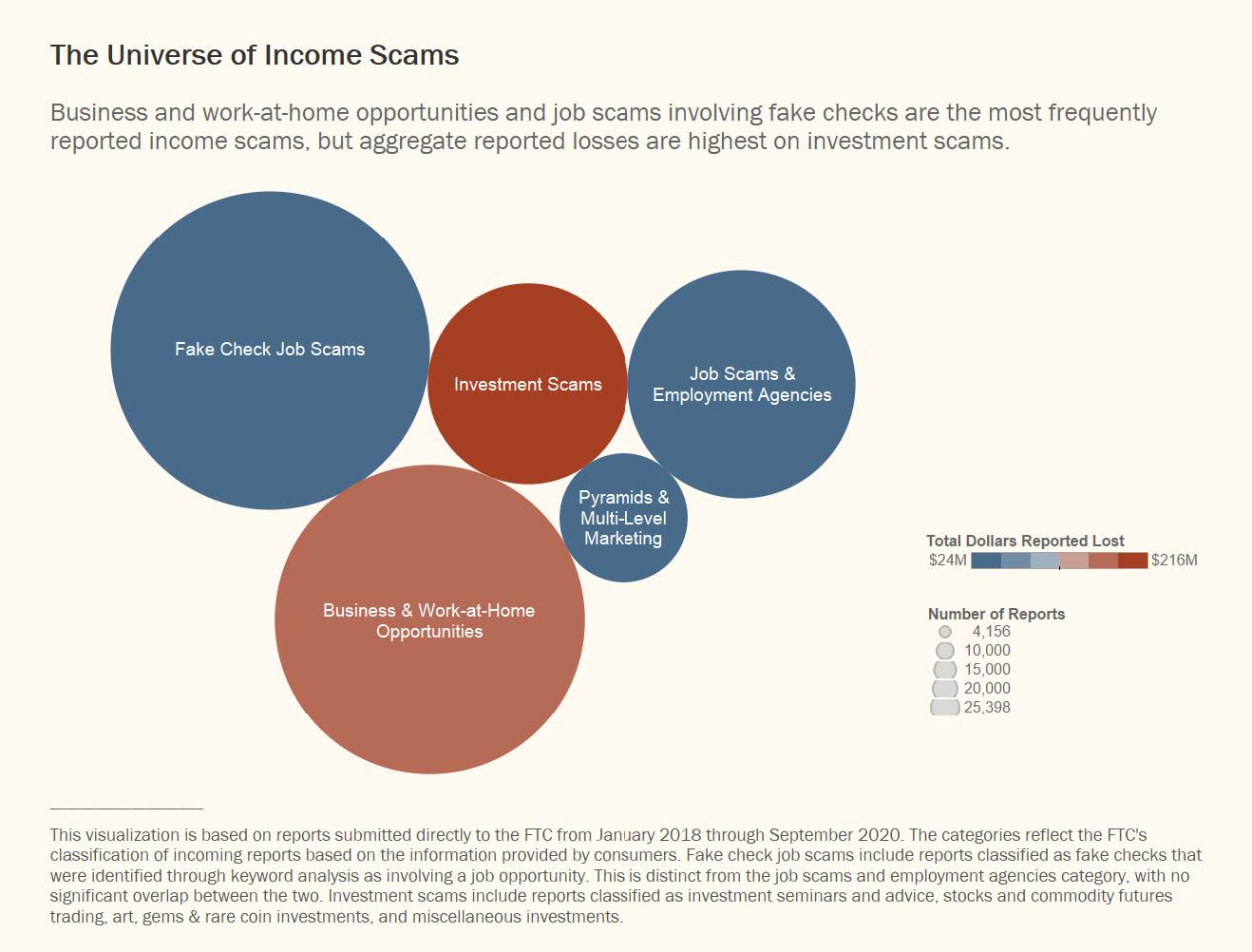

Income scams: big promises, big losses bcooper1 December 10, 2020 | 3:29PM Income scams: big promises, big losses By Emma Fletcher When the job market is tough, scammers target people who are looking for work or trying to bring in extra income. Economic conditions caused by the COVID-19 pandemic may have created ideal conditions for these scams to proliferate. In fact, the volume of reports to the FTC about income scams reached the highest levels on record in the second quarter of 2020.1 These income scams take many forms. Looming large are phony job offers involving fake checks. Schemes that promise to teach you insider secrets to start your own business are part of the mix, too, as are investment scams promising high returns. Chain letters and pyramid schemes are also popping up. People have reported losing about $610 million from income scams since 2016, with nearly $150 million reported lost in the first nine months of 2020 alone. Roughly one in three income scam reports is about phony job offers with a fake check as part of the ruse. Sometimes these scams start with an unexpected email about a job. For example, some college students have reported getting messages from someone impersonating their school’s career services office. Other people have reported that the scam started after they applied for a job or posted a resume online. After a speedy hiring process, people get a supposed paycheck to deposit. But there’s always a plausible explanation for why they can’t keep all the money. Scammers tell people hired as “mystery shoppers” to buy gift cards as they evaluate a retailer (the scammers get the gift card PIN numbers, of course). People hired as “virtual personal assistants” are told to send some of the money to a supposed supplier of home office equipment. Other people have even reported that their so-called boss told them to use some of the funds to buy gift cards for co-workers sick with COVID-19. These scams work because banks have to make funds from deposited checks available within a day or two, but it can take weeks to uncover a fake. When you see the funds in your account, parting with some of the money may feel risk-free. But when the fake check ultimately bounces, the bank will want you to pay back the funds. The median reported loss on fake check job scams is $2,3002, and adults in their 20s are more than three times as likely to report a loss on a fake check job scam than other age groups.3 Another common tactic income scams use is making false claims about likely earnings from starting your own business. Business opportunity scammers promise attractive incomes to trick entrepreneurial people into buying bogus marketing services, training, or coaching programs. But despite testimonials that flaunt lavish lifestyles, their “proven systems” just don’t work. People have reported that some scammers are even invoking the pandemic as part of their pitch in offering work-at-home “opportunities.” But these opportunities frequently add up to huge losses. In fact, the median individual loss people report on business and work-at-home opportunities is $3,000, and for people in their 60s and 70s, the reported median loss is four times higher.4 Drumming up interest in investments is another lucrative tactic scammers deploy. Many investment seminar cons work by promising to teach people how to earn high returns on things like trading online or investing in real estate. But people report losing more on these scams than on any other fraud: the reported median individual loss is over $16,000. People in their 50s and 60s are more likely than other age groups to report losing money on these cons,5 and their reported median individual losses are nearly $24,000. Some income scams put people to work as unwitting accomplices in another scam, costing people their time and effort. People report being hired on a 30-day probationary period, with titles like “logistics manager.” The scammers tell them their job is to receive and reship packages. What they don’t know is that they’re reshipping items bought with stolen credit cards. And after their probationary period ends, the scammers simply cut off communication without ever paying the person. Another variety is the pyramid scam. That old scam got new life by using novel names, like “blessing looms,” “circle games,” and “sou-sous.” A sou-sou is a collective savings club with historic roots in West Africa and the Caribbean. In a real sou-sou, money is rotated within a family or close-knit group, and everyone gets back what they contribute. Fake sou-sous, on the other hand, are pyramid schemes or chain letters. Like so-called blessing looms, they claim you’ll multiply the money you put in. But unlike a real sou-sou, payouts depend on recruiting new members – like family and friends. People typically lose all the money they invest. While reports of fake sou-sous by any name are still relatively low, they increased sharply starting in the second quarter of 20206,and nearly 40% of people who reported said they heard about the supposed opportunity on social media.7 It is clear that income scams take many different forms, but they share some tell-tale signs. Keep these tips in mind to avoid income scams: Take your time. Avoid high-pressure sales pitches that require you to get involved now or risk losing out. Be skeptical about “success stories” and testimonials. Glowing stories could be fake and online reviews may have come from made-up profiles. Don’t bank on a “cleared” check. If you’re told to send some of the money or buy gift cards, you can bet it’s a fake even if you see the money in your account. Do your research. Search online for the company’s name plus words like review, scam, or complaint. To learn more, visit ftc.gov/incomescams. If you spot a scam, report it to the FTC at ReportFraud.ftc.gov. 1 In Q2 2020, 11,879 income scams were reported, a 70% increase from reports captured in Q2 2019. In total, 29,419 income scams were reported directly to the FTC in 2020 through Q3, compared to 26,719 in all of 2019. These figures do not include the complaints collected by other organizations that contribute to Sentinel. Counting all reports to the FTC or any Sentinel data contributor, there were 44,274 income scam reports in 2020 through Q3 and 52,837 such reports in all of 2019. Income scams are defined in this Spotlight as frauds reported directly to the FTC classified as business and work-at-home opportunities, job scams and employment agencies, pyramids and multi-level marketing, investment seminars and advice, stocks and commodity futures trading, art, gems and rare coin investments, and miscellaneous investments. Additionally, reports about fake check scams that were identified through a keyword analysis as involving a job or other income opportunity are included. 2 The median individual reported dollar loss figures provided in this Spotlight are based on reports directly to the FTC for a robust and recent time period, January 2018 through September 2020. 3 From January 2018 through September 2020, 83% of income scam reports included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020). 4 See endnote 2. The median individual dollar loss on reports classified as business and work-at-home opportunities submitted by consumers ages 60-79 was $12,000. 5 This age comparison is based on the methodology explained in endnote 3. 6 Reports of fake sou sou scams increased from an average of less than one report per quarter from Q1 2017 through Q1 2019 to 47 reports in Q2 2020 and 191 reports in Q3 2020. These scams were identified through keyword analysis of the narratives provided in income scam reports. Reports about multi-level marketing companies (MLMs) and pyramid schemes of all types doubled in the second quarter. 7 Reports in which the consumer heard about the fake sou sou on social media include income scam reports where the method of contact was specifically identified as social network, and reports where the method of contact was not specified, specified as internet, or consumer initiated contact, if the comments field also included mention of Facebook, Instagram, LinkedIn, Pinterest, Reddit, Snapchat, TikTok, Tumblr, Twitter, or YouTube.

- Don’t bank on a “cleared” checkby sfelder on February 10, 2020 at 3:30 pm

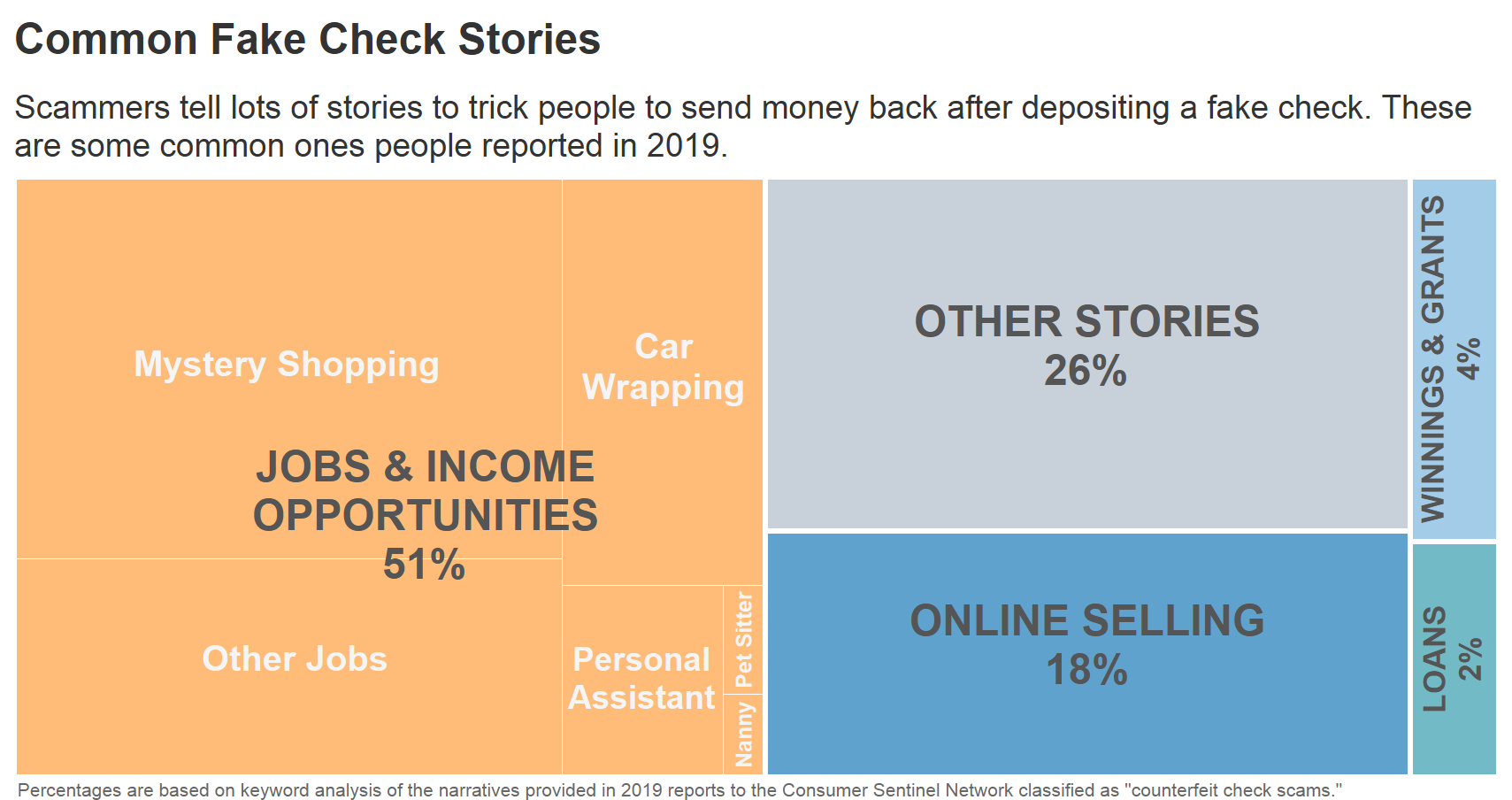

Don’t bank on a “cleared” check sfelder February 10, 2020 | 10:30AM Don’t bank on a “cleared” check By Emma Fletcher Fake check scams take advantage of what we don’t know about how banks handle check deposits. Scammers do know, and they trick people into sending them money before the bank spots the fake. The FTC’s Consumer Sentinel Network database shows that people reported more than 27,000 fake check scams in 2019, with reported losses topping $28 million dollars.1 And the data suggest that fake check scams disproportionately harm young adults – especially people in their twenties. Scammers have various fake check storylines, and job and income opportunities top the list. Last year, about 50% of people who reported a fake check scam to the FTC said they were offered a job or some other way to earn money.2 Nearly half of those were fake mystery shopping jobs, and many others were phony car-wrap advertising opportunities. In another 18% of the reports, people said they got a fake check as payment for something they were selling online. Fake check scams have two telltale elements – a check to deposit and a plausible explanation for why you can’t keep all the money. The checks come in many varieties: a business or personal check, a cashier’s check, money order, or even a check delivered electronically. The ploys to get you to send back some of the money also vary. Potential mystery shoppers are told to use some of the money to “evaluate” a retailer by buying gift cards or money orders, or by wiring money through MoneyGram or Western Union. (The scammers make sure to get the gift card PIN number from you, or delay you from canceling the money order.) People who apply online and are hired as “personal assistants” are told to use the money to buy gift cards for the new boss (and, again, to give up those PIN numbers). People interested in car wrap advertising are told to send money to supposed decal installers – who never materialize. People buying something from you online “accidently” send a check for too much and ask you to refund the balance. These scams work because, once you deposit a check, you quickly see the funds in your account. Parting with some of that money then feels risk-free. But scammers know that while the law says banks have to make funds from deposited checks available within a day or two, it can take weeks to uncover a fake. Some scammers even tell you to wait for the check to “clear” before sending money. When it ultimately bounces, the bank can take back the amount of the fake check, leaving you on the hook for the money. Say you deposited a check for $1,000 and sent $600. A while later, the bank finds out the check was fake. It withdraws the full $1,000 from your account. Now, you’re out $600. If you didn’t have money in your account to cover that loss, you also have a negative balance. The number of reports made directly to the FTC about fake checks are on the rise – they’re up by about 65% over 2015 levels.3 What’s more, no other fraud among last year’s top ten most frequently reported scams came close to the individual losses people reported on fake check scam last year.4 The median individual loss reported on fake checks was $1,988, compared to $320 on all fraud types combined. And people reported that the scammers often asked to be paid by gift card or wire transfer. Con artists favor these payment methods because once the money is sent, it is almost impossible to trace or reverse. Younger people are hit especially hard. Last year, people in their twenties were more than twice as likely as people 30 and older to report losing money on a fake check scam.5 Many college students have reported that the scam started with a message sent to their student email address. Scammers make these emails seem official – they may even impersonate the school’s career services office. To avoid these scams, here are a few things to know: If someone sends you a check and tells you to send money – whether by wiring money or buying gift cards – you can bet it’s a scam. Even if you see the money in your account, the bank can still take it back if the check later bounces. If you don’t know the person who wrote the check, don’t send money. Period. If you’re selling online, never accept a check for more than your asking price. To learn more about what to do if you have already sent money to a scammer, visit ftc.gov/fakechecks. If you paid a scammer with a gift card, visit ftc.gov/giftcards. If you spot a scam, report it to the FTC at ftc.gov/complaint. 1 These figures are based on fraud reports classified as “counterfeit check scams” submitted in 2019 by any person or data contributor and stored in the Consumer Sentinel Network database. 2 Figures pertaining to the nature of the scammers’ stories are based on keyword analysis of the narratives provided in 2019 reports classified as “counterfeit check scams.” 3 This figure is based on 14,017 reports about fake check scams submitted directly to the FTC in 2015 as compared to 23,064 such reports in 2019. In 2016, 2017, and 2018 respectively, 15,840, 17,870 , and 18,463 such reports were submitted. These figures exclude data contributors to ensure the data reflects consistency in complaint capture over time. 4 Of the nearly 60 Sentinel fraud subcategories, fake check scams ranked ninth based on the total number of fraud reports submitted in 2019. Of the ten most frequently reported frauds, government imposter scams had the second highest reported median individual loss of $1,100. Reports classified as unspecified are excluded. 5 In 2019, 77% of fake check reports included usable age information. This age comparison is normalized based on the number of loss reports per million population by age. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States, States, Counties and Puerto Rico Commonwealth and Municipios (June 2019).

FTC Data Spotlight Blog

We are an ethical website cyber security team and we perform security assessments to protect our clients.