- Top text scams of 2024by bacree on April 14, 2025 at 11:56 am

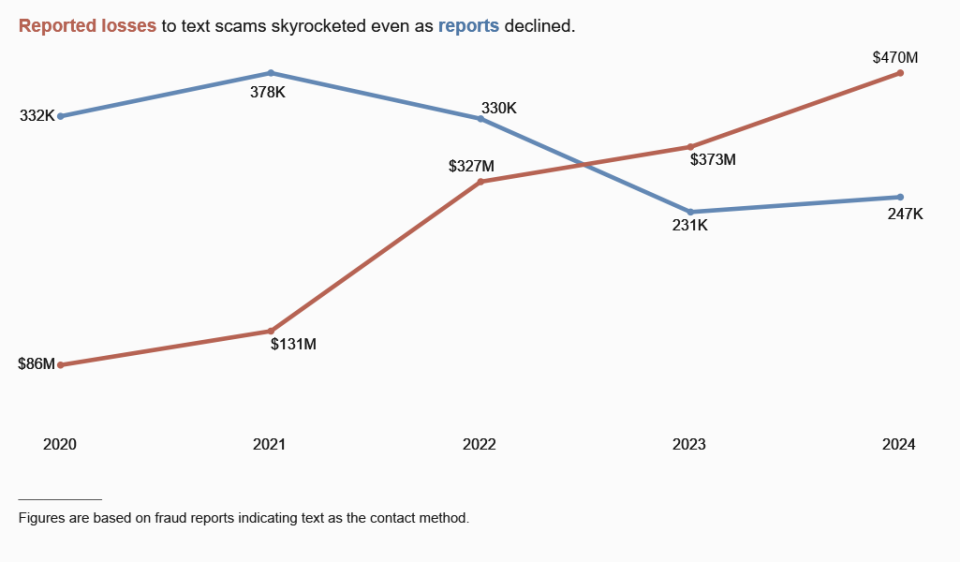

Top text scams of 2024 bacree April 14, 2025 | 7:56AM Top text scams of 2024 By Division of Consumer Response and Operations Staff It’s hard not to glance at your phone when you hear the ding of an incoming text.[1] Scammers bet on it. And reports to the FTC’s Consumer Sentinel Network suggest their odds of a big payout have improved: reported losses to text scams have skyrocketed even as the number of reports declined. In 2024, people reported $470 million in losses to these scams, more than five times the 2020 number.[2] And since the vast majority of frauds are never reported, this number likely reflects only a fraction of the actual harm.[3] Image While there are countless varieties of text scams, the top five described below are estimated to account for about half of all text frauds reported to the FTC’s Consumer Sentinel Network in 2024.[4]1) Fake package delivery problemsMessages about package deliveries, usually from someone pretending to be from the U.S. Postal Service, were the most reported text scam last year. These messages say there’s a problem with a delivery and link to a website that looks like the real USPS site – but isn’t. Many people reported paying a small “redelivery fee” that turned out to be a trick to get their credit card or even Social Security number. 2) Phony job opportunitiesScammers posing as recruiters to take people’s money isn’t new. But in 2024, reports of a new “task scam” took off.[5] These scams often start with an unexpected text offering work without specifics. The “job” is to complete simple repetitive tasks like rating products or apps. But it’s all fake. At some point, people are told to send money to finish their tasks and withdraw their supposed earnings. But people who sent money said that they didn’t get it back.3) Fake fraud alertsMany people reported texts about so-called suspicious activity or a big purchase they didn’t make. These texts often look like they’re from a bank or Amazon. They might give a number to call. Or they might say to reply YES or NO to verify a large transaction. People who reply are connected to the (fake) fraud department for “help” fixing the made-up problem. These scammers quickly up the ante, often telling people all their money is at risk. The scammers then pressure people into moving money out of their accounts to supposedly keep it safe, but it really goes to the scammers. And people who move that money do not get any of it back.4) Bogus notices about unpaid tollsScammers are sending texts that look like they’re from highway toll programs all over the country, from SunPass in Florida to FasTrak in San Francisco. These scammers tell people to click a link to pay an unpaid balance, but neither the charges nor the message are legit. Reports show these scammers are really after credit card and even Social Security numbers.5) “Wrong number” texts that aren’tWrong number scams start with an out-of-the-blue message that looks innocent enough – it might just say “hello” or “do you want to get a coffee?” But a simple act of kindness – responding to let a stranger know they have the wrong number – can be the start of a very costly scam. Reports show these scammers strike up a fake friendship, often with romantic undertones. Next, they claim to be successful investors, offering to share their tricks and directing people to bogus investment platforms. People report losing all the money they “invest,” often tens of thousands of dollars. Image Here are some things you can do to help stop text scams:Forward messages to 7726 (SPAM). This helps your wireless provider spot and block similar messages.Report it on either the Apple iMessages app or Google Messages app for Android users.Report it to the FTC at ReportFraud.ftc.gov.How can you avoid text scams?Never click on links or respond to unexpected texts. If you think it might be legit, contact the company using a phone number or website you know is real. Don’t use the information in the text message.Filter unwanted texts before they reach you. There are a few ways to block unwanted texts.To learn more about how to spot and avoid scams – and how to recover money if you’ve paid a scammer – visit ftc.gov/scams. Learn more about text scams at ftc.gov/textscams. [1] Text message open rates are estimated to be as high as 98%, and response rates as high as 45%, as compared to email open and response rates of 20% and 6% respectively. More than half of consumers text daily, making texting more common than any other communication method, including voice or email. See FCC, Consumer Advisory Committee, Report on the State of Text Messaging at 5 (August 2022), available at https://files.fcc.gov/ecfs/download/20970528-9c2e-400d-951b-1024118e50fb?orig=true&pk=cb77b2ec-1a58-dbc6-139b-ad192cfd5d9b. [2] The share of text scam reports indicating that money was lost increased as follows: 5% (2020), 4% (2021), 6% (2022), 9% (2023), 11% (2024). These figures are available with quarterly updates at https://public.tableau.com/shared/MNHYNJWNT?:display_count=n&:origin=viz_share_link.[3] See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021) (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).[4] The top text scams were identified by hand-coding a random sample of 1,000 2024 text fraud reports containing a narrative description. The scam types identified here do not replace the subcategories the FTC publishes in its annual Consumer Sentinel Network Data Book, but rather provide more detail. For example, most toll and delivery scams are classified as imposter scams. The most recent aggregate data on text scams is available at https://public.tableau.com/shared/P3J7W6S4N?:display_count=n&:origin=viz_share_link.[5] See the December 2024 Data Spotlight for more information about task scams.

- Who’s who in scams: a spring roundupby bjames@ftc.gov on May 24, 2024 at 1:00 pm

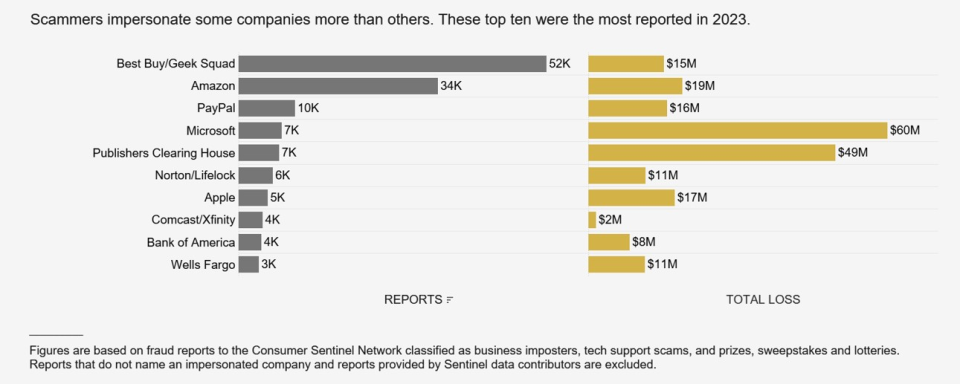

Who’s who in scams: a spring roundup bjames@ftc.gov May 24, 2024 | 9:00AM Who’s who in scams: a spring roundup By Emma Fletcher Scammers are all about spinning lies, but they still operate in the real world. Many scammers pretend to be well-known businesses to gain trust and make their stories seem more believable.[1],[2]And scammers use real-world methods to contact people and to get paid. Reports to the FTC’s Consumer Sentinel Network point to some of their favorites.Let’s start with the most-impersonated companies. According to 2023 reports, Best Buy’s Geek Squad, Amazon, and PayPal top that list. But reported losses tell a different story: losses were highest when scammers impersonated Microsoft and Publishers Clearing House.[3] The scammers impersonating these businesses work in very different ways. For example, phony Geek Squad emails tell you that a computer service you never signed up for is about to renew – to the tune of several hundred dollars. Microsoft impersonation scams start with a fake security pop-up warning on your computer with a number to call for “help.”[4] And calls from the fake Publishers Clearing House say you’ll have to pay fees to collect your (fake) sweepstakes winnings. Image Reports about all types of fraud also tell us how scammers contacted their targets. Last year, people told us that scammers were most often reaching out by email and phone calls. But people also told us that they lost the most money on scams that started on social media.[5]People most frequently named Facebook and Instagram in these reports,[6] and most often reported online shopping scams that started with ads on social media. However, the largest reported losses to scams starting on social media platforms were to investment scams.How scammers get their money varies by the type of scam, too. For example, people who report investment scams most often say they “invested” with cryptocurrency or via bank transfer.[7] Reported payments to scammers by these two methods added up to the highest losses in 2023, both per person and in total.[8] And many people reported using payment apps and services, most often in connection with online shopping scams.[9] Most people who reported using a payment app or service named the company they used, with PayPal, Cash App, Zelle, Venmo, and Apple Pay most often reported in 2023.Gift cards were the top reported payment method on several types of scams in 2023, including romance scams, tech support scams, government impersonation scams, and scams that impersonate people you know, like your boss or a grandchild. Reports show that scammers specify what gift card brand to buy, which most people named in their reports. In 2023, Apple cards were far and away the most reported gift card brand, followed by Target, eBay, Walmart and Amazon gift cards.[10] Image So, how can you spot and avoid these and other scams?Stop and check it out. Before you do anything else, talk with someone you trust. Anyone who’s rushing you into sending money, buying gift cards, or investing in cryptocurrency is almost certainly a scammer.Never click on links or respond to unexpected messages, and never trust caller ID. If you think a story might be legit, contact the company or agency using a phone number or website you know is real.Don’t pay anyone who demands that you pay by gift card, cryptocurrency, money transfer, or payment app. Only scammers say there’s only one way to pay.And what can businesses do? At minimum, make it easier for customers to reach you to find out what communications are legit. Of course, shifting responsibility onto your customers isn’t the answer, so look to your workforce’s ingenuity to deploy solutions that protect your loyal customers and your good name.To spot and avoid scams – and learn how to recover money if you paid a scammer – visit ftc.gov/scams. Visit business.ftc.gov to get resources and advice for businesses. Report scams to the FTC at ReportFraud.ftc.gov [1] In 2023, about 332,000 people reported a business impersonation scam, far more than any other fraud type, and reported losses totaled over $660 million. These figures, and figures throughout this Spotlight, exclude reports provided by data contributors. Because the vast majority of frauds are not reported to the government, these figures reflect just a small fraction of the public harm. See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity). [2] Government agencies, including the FTC, are often impersonated as well. For more information about government impersonation reporting data, including the most reported agencies, see FTC’s interactive Tableau Public infographic. [3] Microsoft impersonation reports are generally classified as tech support scams and Publishers Clearing House impersonation reports are generally classified as prizes, sweepstakes, and lotteries. These two Sentinel fraud types were included in this analysis in addition to the business imposter fraud type as they generally include reports about impersonated companies. [4] See FTC Consumer Alert, New tech support scammers want your life savings (March 2024) available at https://consumer.ftc.gov/consumer-alerts/2024/03/new-tech-support-scammers-want-your-life-savings [5] Reported losses to fraud that started on social media by year are as follows: $237M (2020), $729M (2021), $1.1B (2022), $1.4B (2023). More money was reported lost to fraud starting on social media than any other contact method in 2021, 2022, and 2023. For more information about contact method and payment method reporting data, see FTC’s interactive Tableau Public dashboard. [6] In 2023, 51% of reports about fraud starting on social media identified Facebook as the social media platform, and 22% identified Instagram. This excludes reports that did not identify a social media platform. [7] Of the $1.8 billion reported lost to investment-related fraud in 2023, $707 million was lost using cryptocurrency and $689 million was lost using bank transfers. [8] In 2023, compared to all other payment methods, total reported losses were highest on bank transfers ($1.7B) followed by cryptocurrency ($1.2B), and median individual reported losses were highest on cryptocurrency ($5,000) followed by bank transfers ($4,581). [9]Credit cards, debit cards, and payment apps and services were the top three most reported payment methods, though people tended to report losing less money to the scammer. In 2023, the median individual reported losses for these payment methods were as follows: payment app or service ($380), credit card ($136), and debit card ($110). [10] For earlier Sentinel data about gift card brands, see FTC Data Spotlight, Scammers prefer gift cards, but not just any card will do (December 2021) available at https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2021/12/scammers-prefer-gift-cards-not-just-any-card-will-do.

- IYKYK: The top text scams of 2022by bjames@ftc.gov on May 15, 2023 at 3:24 pm

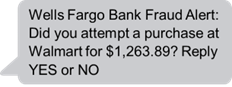

IYKYK: The top text scams of 2022 bjames@ftc.gov May 15, 2023 | 11:24AM IYKYK: The top text scams of 2022 By Emma Fletcher Texting is cheap and easy, and scammers are counting on the ding of an incoming text being hard to ignore.[1] In 2022, they were right to the tune of $330 million in losses to text scams, as reported to the FTC’s Consumer Sentinel Network, with a median reported loss of $1,000. That’s more than double the 2021 reported losses and nearly five times what people reported in 2019.[2] In fact, reports about text scams spiked in the first six months of the COVID-19 pandemic and have never returned to pre-pandemic levels.[3]But why do they work? Scammers use the speed of text communication to their advantage: they hope you won’t slow down and think over what’s in the message. Some messages promise a good thing – a gift, a package, or even a job. Others try to make you panic, thinking someone’s in your accounts. These are all lies and ways to take your money and personal information.While there are countless varieties of text scams, the top five described below account for over 40% of randomly sampled text frauds reported in 2022.[4] All five have one thing in common – they often work by impersonating well-known businesses.[5]1) Copycat bank fraud prevention alertsReports about texts impersonating banks are up nearly twentyfold since 2019.[6] You might get a fake number to call about supposed suspicious activity. Or they might say to reply “yes or no” to verify a large transaction (that you didn’t make). If you reply, you’ll get a call from the (fake) fraud department. People say they thought the bank was helping them get their money back. Instead, money was transferred out of their account. This scam’s median reported loss was a whopping $3,000 last year. Worse still, many people report giving their Social Security number and other personal information to scammers, leading to possible identity theft.2) Bogus “little gifts” that can cost youA text about a free gift, reward, or prize may look like it came from a company you know – say, your cell phone company or a big retailer. But everything about this is fake. If you click the link and pay a small “shipping fee,” you just gave your credit card number to a scammer. Reports tell us fraudulent charges soon follow.3) Fake package delivery problemsExpecting a package? There’s a text scam for you. Texts pretending to be from the U.S. Postal Service, FedEx, and UPS say there’s a problem with a delivery.[7] They link to a website that looks real – but isn’t. If you paid a small “redelivery fee,” which many people reported, that was a trick to get your credit card number. People also reported giving these scammers their personal information, including Social Security numbers.4) Phony job offersPromises of easy money for mystery shopping at well-known stores like Whole Foods and Walmart are an old scammer favorite. Reports about bogus offers to make money driving around with your car wrapped in ads are also common. Reports show job scammers also target people who post their resumes to employment websites like Indeed. In most of these reports, scammers use checks that seem to “clear” but turn out to be fake to trick people into sending them money.[8]5) Not-really-from-Amazon security alertsLike fake bank texts, texts from someone who says they’re “Amazon” look like automated fraud prevention messages. Often, they ask you to verify a big-ticket order you didn’t make. If you call the number in the text, you get a phony Amazon rep who offers to “fix” your account. People often report giving the rep remote access to their phone so they can get things fixed and get their refund.[9] But then the rep says a couple of zeros were accidently added to the refund, so they need you to return that money to them – often by buying gift cards and giving the cards’ PIN numbers.In all of these cases, reporting can help stop scam text messages:Forward it to 7726 (SPAM). This helps your wireless provider spot and block similar messages.Report it on either the Apple iMessages app or Google’s Messages app for Android users.Report it to the FTC at ReportFraud.ftc.gov.How can you avoid text scams?Never click on links or respond to unexpected texts. If you think it might be legit, contact the company using a phone number or website you know is real. Don’t use the information in the text message.Filter unwanted texts before they reach you. There are a few ways to block unwanted texts.To learn more about how to spot and avoid scams – and how to recover money if you’ve paid a scammer – visit ftc.gov/scams. Learn more about text scams at ftc.gov/textscams.[1] Text message open rates are estimated to be as high as 98%, and response rates as high as 45%, as compared to email open and response rates of 20% and 6% respectively. More than half of consumers text daily, making texting more common than any other communication method, including voice or email. See FCC, Consumer Advisory Committee, Report on the State of Text Messaging at 5 (August 2022), available at https://files.fcc.gov/ecfs/download/20970528-9c2e-400d-951b-1024118e50fb?orig=true&pk=cb77b2ec-1a58-dbc6-139b-ad192cfd5d9b.[2] Aggregate reported losses to text fraud by year are as follows: $67M (2019), $86M (2020), $131M (2021), $330M (2022). Text fraud is defined here and throughout this Spotlight as fraud reports indicating text as the contact method. Because the vast majority of frauds are not reported to the government, these figures reflect just a small fraction of the public harm. See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).[3] The number of text fraud reports by year are as follows: 137K (2019), 332K (2020), 378K (2021), 330K (2022). The number of reports spiked in Q3 2020, with 125K reports in that quarter alone.[4] The top scam types were identified by hand-coding a random sample of 1,000 2022 text fraud reports containing a narrative description. For each scam type, the margin of error for the share of complaints in that type is +/-3.1%, given a 95% confidence level. The scam types identified here do not replace the subcategories the FTC publishes on www.ftc.gov/exploredata, but rather provide more detail. The subcategories published on www.ftc.gov/exploredata primarily reflect topics consumers self-select on www.reportfraud.ftc.gov or report to the FTC call center or Sentinel data contributors. Reports on www.ftc.gov/exploredata may be tagged with multiple subcategories.[5] In 2022, 51% of reports about text fraud were categorized in Sentinel as business imposters. This excludes reports categorized as unspecified. [6] The number of fraud reports about text messages claiming to be from banks by year are as follows: 1,355 (2019), 2,231 (2020), 13,677 (2021), 25,725 (2022). The top companies identified in 2022 reports about bank impersonation text scams were Bank of America (14%), Wells Fargo (12%), Chase (12%), and Citibank (9%). These figures exclude reports that did not include a company name.[7] Many U.S. Postal Service delivery reports are categorized as government imposters on www.ftc.gov/exploredata.[8] By law, banks must make deposited funds available quickly. The bank may say the check has “cleared” when funds are made available, but it can take weeks for the bank to uncover a fake check. The bank can take back the amount of the check once it is detected as fake. Reports show fake checks are often used to trick people into, for example, sending money to fake car wrap installers or buying gift cards at retailers as supposed mystery shoppers.[9] See the June 2021 Data Spotlight for more information about Amazon impersonation scams.

- Reports show scammers cashing in on crypto crazeby bacree on June 3, 2022 at 8:53 pm

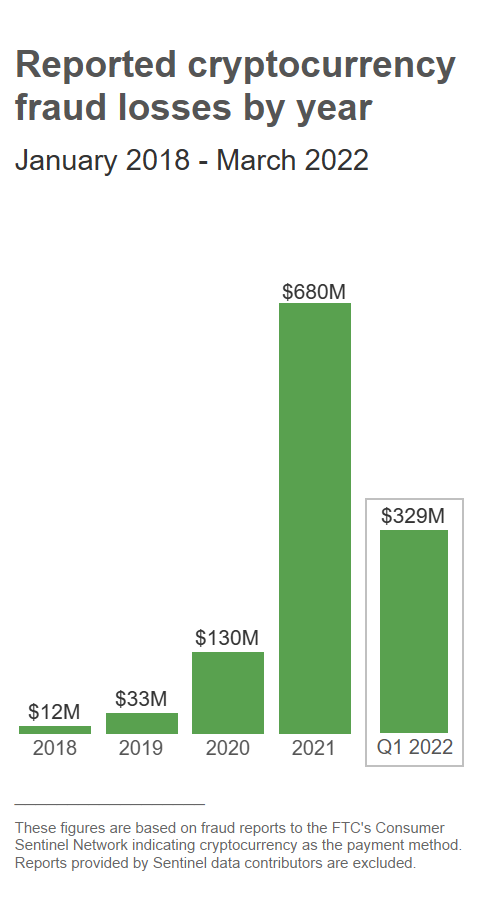

Reports show scammers cashing in on crypto craze bacree June 3, 2022 | 4:53PM Reports show scammers cashing in on crypto craze By Emma Fletcher From Super Bowl ads to Bitcoin ATMs, cryptocurrency seems to be everywhere lately. Although it’s yet to become a mainstream payment method, reports to the FTC show it’s an alarmingly common method for scammers to get peoples’ money. Since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams[1] – that’s about one out of every four dollars reported lost,[2] more than any other payment method. The median individual reported loss? A whopping $2,600. The top cryptocurrencies people said they used to pay scammers were Bitcoin (70%), Tether (10%), and Ether (9%).[3] Crypto has several features that are attractive to scammers, which may help to explain why the reported losses in 2021 were nearly sixty times what they were in 2018. There’s no bank or other centralized authority to flag suspicious transactions and attempt to stop fraud before it happens. Crypto transfers can’t be reversed – once the money’s gone, there’s no getting it back. And most people are still unfamiliar with how crypto works. These considerations are not unique to crypto transactions, but they all play into the hands of scammers. Reports point to social media and crypto as a combustible combination for fraud. Nearly half the people who reported losing crypto to a scam since 2021 said it started with an ad, post, or message on a social media platform.[4] Image During this period, nearly four out of every ten dollars reported lost to a fraud originating on social media was lost in crypto, far more than any other payment method.[5] The top platforms identified in these reports were Instagram (32%), Facebook (26%), WhatsApp (9%), and Telegram (7%).[6] Of the reported crypto fraud losses that began on social media, most are investment scams.[7] Indeed, since 2021, $575 million of all crypto fraud losses reported to the FTC were about bogus investment opportunities, far more than any other fraud type. The stories people share about these scams describe a perfect storm: false promises of easy money paired with people’s limited crypto understanding and experience. Investment scammers claim they can quickly and easily get huge returns for investors. But those crypto “investments” go straight to a scammer’s wallet. People report that investment websites and apps let them track the growth of their crypto, but it’s all fake. Some people report making a small “test” withdrawal – just enough to convince them it’s safe to go all in. When they really try to cash out, they’re told to send more crypto for (fake) fees, and they don’t get any of their money back. Romance scams are a distant second to investment scams, with $185 million in reported cryptocurrency losses since 2021 – that’s nearly one in every three dollars reported lost to a romance scam during this period.[8] And many have an investment twist too. These keyboard Casanovas reportedly dazzle people with their supposed wealth and sophistication. Before long, they casually offer tips on getting started with crypto investing and help with making investments. People who take them up on the offer report that what they really got was a tutorial on sending crypto to a scammer. The median individual reported crypto loss to romance scammers is an astounding $10,000. Business and government impersonation scams are next with $133 million in reported crypto losses since 2021. These scams can start with a text about a supposedly unauthorized Amazon purchase, or an alarming online pop-up made to look like a security alert from Microsoft. From there, people are reportedly told the fraud is extensive and their money is at risk. The scammers may even get the “bank” on the line to back up the story. (Pro tip: it’s not the bank.) In another twist, scammers impersonating border patrol agents have reportedly told people their accounts will be frozen as part of a drug trafficking investigation. These scammers tell people the only way to protect their money is to put it in crypto: people report that these “agents” direct them to take out cash and feed it into a crypto ATM. The “agent” then sends a QR code and says to hold it up to the ATM camera. But that QR code is embedded with the scammer’s wallet address. Once the machine scans it, their cash is gone. People ages 20 to 49 were more than three times as likely as older age groups to have reported losing cryptocurrency to a scammer.[9] Reports point to people in their 30s as the hardest hit – 35% of their reported fraud losses since 2021 were in cryptocurrency.[10] But median individual reported losses have tended to increase with age, topping out at $11,708 for people in their 70s.[11] Here are some things to know to steer clear of a crypto con: Only scammers will guarantee profits or big returns. No cryptocurrency investment is ever guaranteed to make money, let alone big money. Nobody legit will require you to buy cryptocurrency. Not to sort out a problem, not to protect your money. That’s a scam. Never mix online dating and investment advice. If a new love interest wants to show you how to invest in crypto, or asks you to send them crypto, that’s a scam. To learn more about cryptocurrency scams – and how to spot and avoid scams generally – visit ftc.gov/cryptocurrency and ftc.gov/scams. Report scams to the FTC at ReportFraud.ftc.gov. [1]These figures and figures throughout this Spotlight, unless otherwise noted, are based on fraud reports made directly to the FTC in the Consumer Sentinel Network database from January 1, 2021 through March 31, 2022 that indicated cryptocurrency as the payment method. Reports provided by Sentinel data contributors are excluded because of inconsistencies among contributors in capturing payment information. Because the vast majority of frauds are not reported, these figures reflect just a small fraction of the public harm. See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity). [2] From January 1, 2021 through March 31, 2022, cryptocurrency was identified as the payment method for 24% of reported dollar losses in fraud reports to the FTC. [3]These figures exclude reports that did not specify the type of cryptocurrency. [4] From January 1, 2021 through March 31, 2022, 49% of fraud reports to the FTC indicating cryptocurrency as the payment method specified that the scam started on social media, compared to 37% in 2020, 18% in 2019, and 11% in 2018. [5] From January 1, 2021 through March 31, 2022, $1.1 billion was reported to the FTC as lost to fraud originating on social media. Of that number, 39% was reported as paid using cryptocurrency, followed by bank transfer or payment (20%), and wire transfer (9%). 8% did not indicate a payment method. [6] These figures exclude reports that did not specify a social media platform. [7] From January 1, 2021 through March 31, 2022, people reported to the FTC that $417 million in cryptocurrency was lost to fraud originating on social media. $273 million of these losses were to fraud categorized as investment related, followed by romance scams ($69 million), and business imposters ($35 million). [8] From January 1, 2021 through March 31, 2022, cryptocurrency was identified as the payment method for 29% of reported dollar losses to romance scams. [9] From January 1, 2021 through March 31, 2022, people ages 20 to 49 submitted fraud loss reports to the FTC indicating social media as the contact method at a rate 3.4 times greater than people 50 and over. About 91% of fraud reports indicating cryptocurrency as the payment method during this period included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020). [10] From January 1, 2021 through March 31, 2022, the percentage of total reported fraud losses that were lost in cryptocurrency by age were as follows: 12% (18-19), 23% (20-29), 35% (30-39), 33% (40-49), 28% (50-59), 19% (60-69), 10% (70-79), and 2% (80 and over). These figures exclude reports that did not indicate age. [11] From January 1, 2021 through March 31, 2022, the median individual reported cryptocurrency losses to fraud by age were as follows: $1,000 (18-19), $1,600 (20-29), $2,500 (30-39), $3,200 (40-49), $5,000 (50-59), $8,500 (60-69), $11,708 (70-79), and $8,100 (80 and over).

- Scammers prefer gift cards, but not just any card will doby sfelder on December 8, 2021 at 2:30 pm

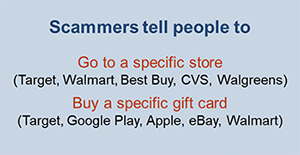

Scammers prefer gift cards, but not just any card will do sfelder December 8, 2021 | 9:30AM Scammers prefer gift cards, but not just any card will do By Emma Fletcher Gift cards are an easy way to give. Reports to the FTC’s Consumer Sentinel show they’re also an easy way to take. About one in four people who report losing money to fraud say it happened when a scammer tricked them into giving the numbers on the back of a gift card.1 Gift cards are far more frequently reported than any other payment method for fraud,2 and the numbers have reached staggering new highs compared to past years.3 In the first nine months of 2021 alone, nearly 40,000 people reported $148 million stolen using gift cards. And because the vast majority of frauds are not reported to the government, this reflects only a fraction of the harm these scams cause.4 Scammers favor gift cards because they are easy for people to find and buy, and they have fewer protections for buyers compared to some other payment options. Scammers can get quick cash, the transaction is largely irreversible, and they can remain anonymous. According to reports received by the FTC, scams demanding gift cards most often start with a phone call from someone impersonating a well-known business or government authority.5 Many people report that a scammer posing as Amazon or Apple told them to send pictures of the numbers on gift cards to fix a supposed security problem with their account. Sometimes they call those numbers “security codes.” But the only thing the numbers are good for is taking the money on the card. Other people report that a scammer claiming to be the Social Security Administration said their bank accounts would be frozen as part of an investigation. They’re told to buy gift cards to avoid arrest or to secure access to their money. Reports also show that scammers asking for gift cards pretend to be a love interest, employer, sweepstakes or lottery company, or family member in trouble. Whatever the story, reports show that scammers don’t settle for just any card – they tell people the specific gift card brands to buy. In the first nine months of 2021, over twice as much money was reported lost on Target gift cards than any other brand. Google Play gift cards were next, followed by Apple, eBay, and Walmart cards. Scammers also tell people where to buy the gift cards. In the first nine months of 2021, people who reported losing money buying gift cards mentioned Target stores more than other retailers. Reports suggest that Walmart, Best Buy, CVS, and Walgreens stores are also popular with scammers. Scammers use lots of tricks to avoid detection. People often say the scammer sent them to several store locations to make multiple purchases. Scammers tell people to stay on the phone with the scammer the entire time – a trick to make sure they don’t call anyone who might help. Scammers even coach people on what to say if a cashier asks questions; they don’t want anyone to stop the scam, and they know store employees are often the only people who can help. Both the number of reported gift card scams and total losses have increased every year since 2018.6 Losses are certainly up due to the higher number of reports, but individuals also report that they’re losing a lot more money. In fact, losses of $5,000 or more have increased from about 8% of reports in 2018 to about 14% in the first nine months of 2021. Over the same period, median reported losses increased from $700 to $1,000. Losses also vary by card brand. Target cards, for example, saw a median reported loss of $2,500 in the first nine months of the year, far higher than other frequently reported cards.7 In addition, 30% of people who paid with a Target card said they lost $5,000 or more.8 Whenever someone demands to be paid with a gift card, that’s a scam. It’s just that simple. Gift cards are for gifts, not for payments. If someone convinced you to give them the numbers on a gift card or send them a photo, hang onto the card and your receipt, and report it to the card issuer right away. You’ll find contact information for some major gift cards at ftc.gov/giftcards. Then report your experience to the FTC at ReportFraud.ftc.gov. If you’re a retailer, or state or local law enforcement, and you’re interested in helping your customers and neighbors avoid gift card scams, visit ftc.gov/StopGiftCardScams to download, print, and share materials in your store and community. 1 From January 2018 through September 2021, 26.6% of consumers who reported losing money to fraud indicated the money was taken using gift cards or reload cards. From January 2021 through September 2021, this figure was 26.1%. Reports that do not indicate a method of payment are excluded. These figures and figures throughout this Spotlight are based on fraud reports directly to the FTC indicating gift card or reload card as the method of payment. Fraud reports classified as “online shopping” are excluded here and throughout this Spotlight because of the legitimate use of gift cards among large retailers. 2 Gift cards were the most frequently reported payment method for fraud in 2018, 2019, 2020, and in the first nine months of 2021. From January 2018 through September 2021, the second most frequently reported payment method was credit cards. From January 2021 through September 2021, the second most frequently reported payment method was cryptocurrency. 3 From January 2021 through September 2021, 39,263 reports indicating $147.8 million in gift card and reload card payments were submitted, compared to 36,682 reports indicating $115.1 million in reported gift card payments in all of 2020. Earlier year figures for comparison purposes are as follows: 35,323 reports with $100 million reported lost (2019), 32,084 reports with $70.6 million reported lost (2018). 4 See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau (“BBB”) or a government entity). 5 From January 2021 through September 2021, 12,239 people reported losing $35.5 million to business impersonators using gift cards, and 7,844 people reported losing $39.6 million to government impersonators using gift cards. Excluding reports that did not indicate a contact method, a phone call was the method of contact in 37% of reports indicating gift cards as the method of payment, followed by email (18%) and social media (16%). 6 See footnote 3. 7 The median individual reported losses from January 1, 2021 through September 30, 2021 by gift card brand are as follows: Target ($2,500), Walmart ($1,380), Apple ($800), eBay ($600), and Google Play ($500). Median individual losses are based on the total loss reported by the consumer, which often includes more than one gift card purchase. 8 The percentage of reports from January 1, 2021 through September 30, 2021 indicating a loss of $5,000 or more by gift card brand are as follows: Target (30%), Apple (13%), Walmart (12%), Google Play (6%), and eBay (3%). Of the $148 million reported lost to gift card scams during this period, $111 million were losses reported by people who reported a loss of $5,000 or more.

- Romance scams take record dollars in 2020by bcooper1 on February 10, 2021 at 1:47 pm

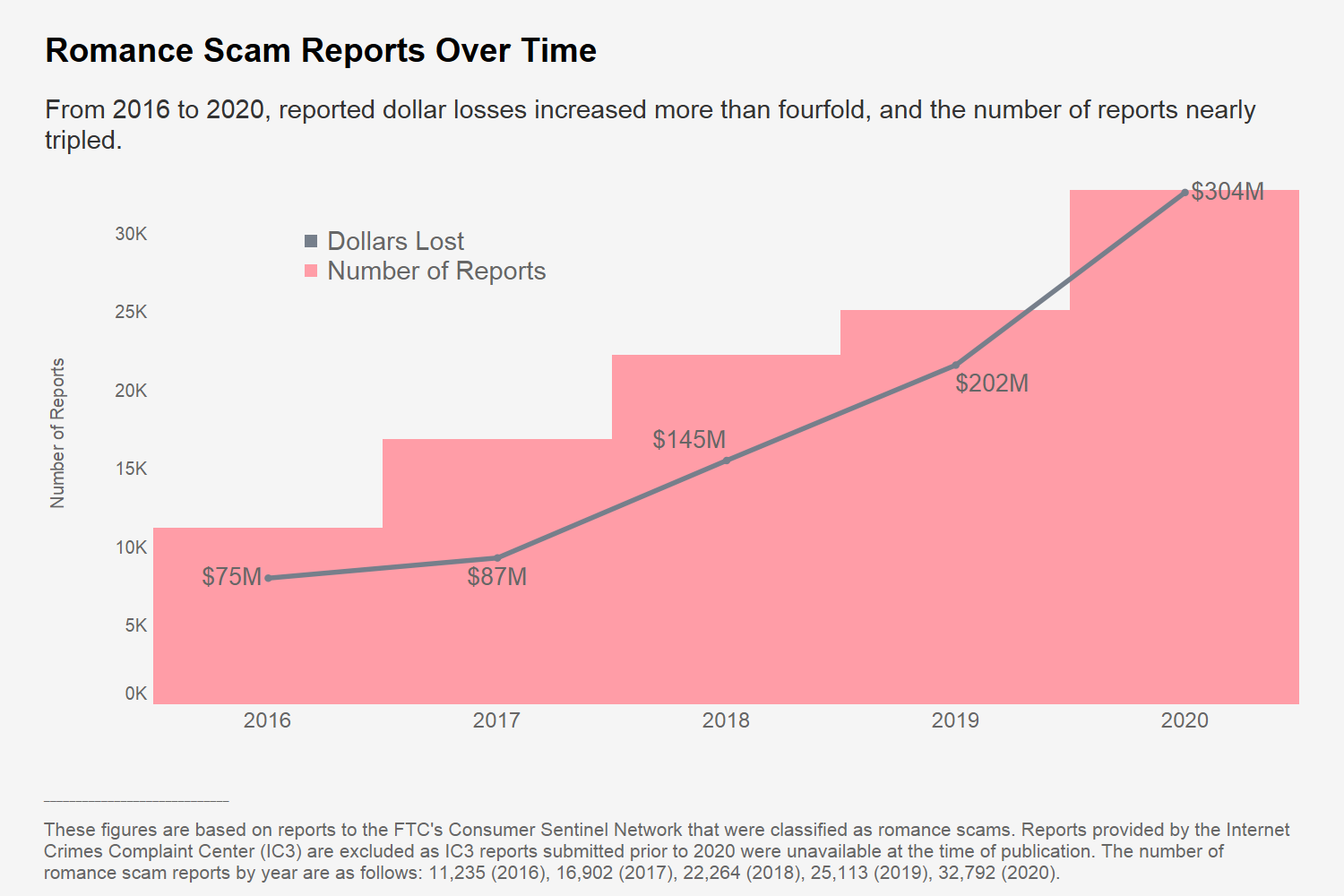

Romance scams take record dollars in 2020 bcooper1 February 10, 2021 | 8:47AM Romance scams take record dollars in 2020 By Emma Fletcher They say love hurts. With romance scams that’s doubly true – hearts are broken and wallets are emptied. For three years running, people have reported losing more money on romance scams than on any other fraud type identified in Sentinel.1 In 2020, reported losses to romance scams reached a record $304 million, up about 50% from 2019. For an individual, that meant a median dollar loss of $2,500. From 2016 to 2020, reported total dollar losses increased more than fourfold, and the number of reports nearly tripled.2 It is reasonable to wonder: what happened in 2020 to make these dollars losses continue to spike? An obvious reason may be the pandemic limiting our ability to meet in person. But outside the pandemic, the share of people who have ever used an online dating site or app has also been rising.3 And romance scammers are primed to take advantage. Scammers fabricate attractive online profiles to draw people in, often lifting pictures from the web and using made up names. Some go a step further and assume the identities of real people. Once they make online contact, they make up reasons not to meet in person. The pandemic has both made that easier and inspired new twists to their stories, with many people reporting that their so-called suitor claimed to be unable to travel because of the pandemic. Some scammers have reportedly even canceled first date plans due to a supposed positive COVID-19 test. While many people report losing money on romance scams that start on dating apps, even more say they were targeted on social media.4 These social media users aren’t always looking for love, and report that the scam often starts with an unexpected friend request or message. Sooner or later, these scammers always ask for money. They might say it’s for a phone card to keep chatting. Or they might claim it’s for a medical emergency, with COVID-19 often sprinkled into their tales of woe. The stories are endless, and can create a sense of urgency that pushes people to send money over and over again. What many of the largest reported dollar losses have in common is that people believe their new partner has actually sent them a large sum of money. Scammers claim to have sent money for a cooked-up reason, and then have a detailed story about why the money needs to be sent back to them or on to someone else. People think they’re helping someone they care about, but they may actually be laundering stolen funds. In fact, many reported that the money they received and forwarded on turned out to be stolen unemployment benefits. In 2020, reports of gift cards being used to send money to romance scammers increased by nearly 70%. Gift cards, along with wire transfers, are the most frequently reported payment methods for romance scams.5 People said they mailed the gift cards or gave the card’s PIN number to the scammer. The median amount people sent romance scammers in 2020 using any method of payment was $2,500, more than ten times the median loss across all other fraud types.6 Reports of money lost on romance scams increased for every age group in 2020. People ages 20 to 29 saw the most striking increase, with the number of reports more than doubling since 2019. People ages 40 to 69 were once again the most likely to report losing money to romance scams.7 And people 70 and older reported the highest individual median losses at $9,475.8 So how can you play it safe while looking for love online? Here are some tips to help you steer clear of scammers: Never send money or gifts to someone you haven’t met in person – even if they send you money first. Talk to someone you trust about this new love interest. It can be easy to miss things that don’t add up. So pay attention if your friends or family are concerned. Take it slowly. Ask questions and look for inconsistent answers. Try a reverse-image search of the profile pictures. If they’re associated with another name or with details that don’t match up, it’s a scam. Learn more at ftc.gov/romancescams. Help stop scammers by reporting suspicious profiles or messages to the dating app or social media platform. Then, tell the FTC at ReportFraud.ftc.gov. 1 The analysis is based on self-reported data from consumers that is stored in the FTC’s Consumer Sentinel Database. It is not a survey that measures prevalence of this particular scam. This analysis excludes fraud reports classified as “Other misc.” 2 Losses sustained in these scams are reported by consumers but not independently verified. These figures and figures throughout this Spotlight are based on reports to the FTC’s Consumer Sentinel Network that were classified as romance scams, excluding reports provided by the Internet Crimes Complaint Center (IC3). IC3 reports submitted prior to 2020 were unavailable at the time of publication, so these reports were excluded to ensure greater consistency in reporting trends over time. . 3 According to the Pew Research Center, the “share of Americans who have used these platforms – as well as the share who have found a spouse or partner through them – has risen over time.” See Monica Anderson, Emily A. Vogels, and Erica Turner, Pew Research Center, The Virtues and Downsides of Online Dating (Feb. 2020, Rev. Jan. 2021), at 3, available at https://www.pewresearch.org/internet/2020/02/06/the-virtues-and-downsides-of-online-dating/. 4 This finding is based on keyword analysis of 2020 Consumer Sentinel Reports classified as a romance scams and indicating a dollar loss. Of these, 2,276 reports mentioned the dating apps Ashley Madison, BLK, Bumble, Chispa, Coffee Meets Bagel, eharmony, EliteSingles, FriendFinder, Grindr, Hinge, Match, OkCupid, OurTime, Plenty of Fish, Seeking Arrangement, SilverSingles, Tinder, WooPlus, or Zoosk. Another 5,924 mentioned Facebook or Instagram. Reports that mentioned one of the specified dating apps and also Facebook or Instagram were excluded from the Facebook or Instagram figure. Because these numbers have not been normalized based on the number of users, they should not be understood as an indication that an individual user of Facebook or Instagram is more likely to encounter a romance scam as compared to users of these dating apps. 5 Wire transfer refers to payments made by wire transfer services such as MoneyGram and Western Union. Gift cards include reload cards (e.g., MoneyPak).. 6 Median loss calculations are based on reports indicating a monetary loss of $1 to $999,999. Reports provided by MoneyGram, Western Union, and Green Dot are excluded for this calculation as these data contributors report each transaction separately, which typically affects calculation of an individual’s median loss. The median individual reported loss for all frauds in 2020, excluding romance scams, was $240. 7 In 2020, 62% of romance scam reports included in this Spotlight included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020). 8 See endnote 6.

- Scams starting on social media proliferate in early 2020by sfelder on October 21, 2020 at 5:30 pm

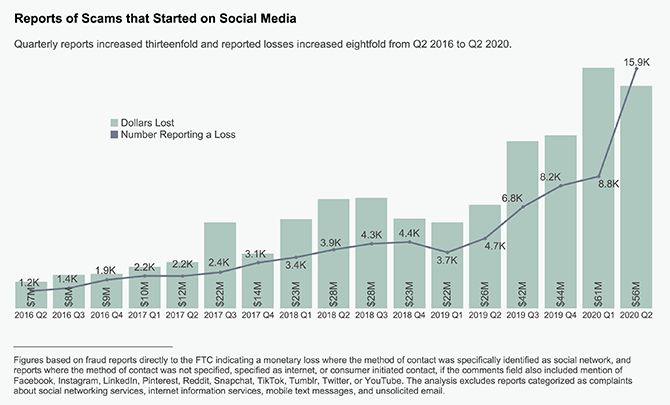

Scams starting on social media proliferate in early 2020 sfelder October 21, 2020 | 1:30PM Scams starting on social media proliferate in early 2020 By Emma Fletcher Social media can be a great way to connect with friends while the pandemic has you keeping your distance. But reports to FTC’s Consumer Sentinel Network suggest that that social media websites and apps have become popular hangouts for scammers, too. Reports that people lost money to scams that started on social media1 more than tripled in the past year, with a sharp increase in the second quarter of 2020. Reports about scams that started on social media have been increasing for years. In 2019, total reported losses to these frauds reached $134 million. But reported losses reached record highs, climbing to nearly $117 million in just the first six months of 2020. In that time, the reported scams that started on social media often related to online shopping, romance scams, and supposed economic relief or income opportunities. Reports about ecommerce sites that don’t deliver the goods top the FTC’s list.2 These reports skyrocketed with the pandemic, and nearly one in four reports to the FTC mentioned a social media hook.3 People mentioned Facebook or Instagram in 94% of reports that identified a specific platform,4 many saying they ordered after seeing an ad. These scam ads look real and can be carefully targeted to reach a particular audience. The scammers can delete comments on their ads or posts, so that negative responses don’t show up and alert people to the con. About half of all romance scam reports to the FTC since 2019 involve social media, usually Facebook or Instagram.5 However, since the pandemic began, more people than ever have reported losing money to romance scams. That includes the scams that start with a social media message or friend request.6 People are increasingly reporting social media messages that offer grant money and other giveaways, supposedly to help people during the pandemic. These scams offer so-called relief to people in need of cash, but scammers are really after your money, your information, or both. These messages can even come from friends who may have been hacked, or who don’t know the offer is a scam, since scammers often tell people to send their message on to others. As people seek more ways to earn money, reports about multi-level marketing (MLM) companies and pyramid schemes – including blessing circles and other gifting schemes – on social media have increased. The numbers were up a staggering fivefold in the second quarter of 2020.7 Many of these recruitment offers reportedly came with extravagant claims about likely earnings, which is always a red flag. Some MLM companies are illegal pyramid schemes: they survive on recruiting new participants rather than selling products. Most people who join an MLM make little or no money with it, while people who become involved with a pyramid scheme typically lose everything they invest. The many scams that show up on social media may benefit from scammers’ low-cost access to entire networks of people. The scammer can hide behind a phony profile, pretend to be someone you know, or even take over a real account. By hiding who they are, they can get into a virtual community you trust, leading you to be more likely to trust them. Here are some tips to help you steer clear of scammers on social media: Before you buy based on an ad or post, check out the company. Type its name in a search engine with words like or “scam” or “complaint.” Never send money to a love interest you have not met in person. If you get a message from a friend about a way to get some financial relief, call them. Did they forward it to you? If not, tell them their account may have been hacked. If so, check it out before you act. Before paying into an “opportunity” to earn money, check out ftc.gov/mlm. Don’t make it easy for scammers to target you – check your social media privacy settings to limit what you share publicly. If you spot a scam, report it to the social media site and the FTC at ftc.gov/complaint. 1 This analysis includes fraud reports directly to the FTC where the method of contact was specifically identified as social network, and reports where the method of contact was not specified, specified as internet, or consumer initiated contact, if the comments field also included mention of Facebook, Instagram, LinkedIn, Pinterest, Reddit, Snapchat, TikTok, Tumblr, Twitter, or YouTube. The analysis excludes reports categorized as complaints about social networking services, internet information services, mobile text messages, and unsolicited email. 2 In Q1 2020 and Q2 2020, 28% of reports of frauds that started on social media were categorized as online shopping fraud where the goods were ordered but not received, followed by romance scams (13%), business imposter scams (6%), family and friend imposters (6%), and government imposter scams (4%). 3 In Q1 and Q2 2020, of the 43,391 reports directly to the FTC about undelivered online shopping orders, 9,832 (23%) indicated the problem started on social media. 4 Of the 9,832 reports (in Endnote 3) about online shopping orders that never arrived, 7,974 reports identified one or more of the social media platforms listed in Endnote 1, including 7,502 that identified Facebook or Instagram. 5 From January 2019 through June 2020, 10,491 (48%) of the 21,941 romance scam reports directly to the FTC were scams that started on social media. Of these, 5,845 identified one or more of the social media platforms listed in Endnote 1, including 5,147 that identified Facebook or Instagram. 6 In Q2 2020, 2,621 people reported a monetary loss on a romance scam directly to the FTC, a 19% increase over the previous quarterly high of 2,208 in Q1 of 2020. 7 These figures are based on reports directly to the FTC categorized as multi-level marketing\pyramids\chain letters. In 2020, reports in this category increased from 387 total reports in the first quarter to 824 total reports in the second quarter. Of those that started on social media, the increase was 94 in Q1, compared to 491 in Q2.

- Identity theft causing outsized harm to our troopsby rcuster on May 21, 2020 at 3:00 pm

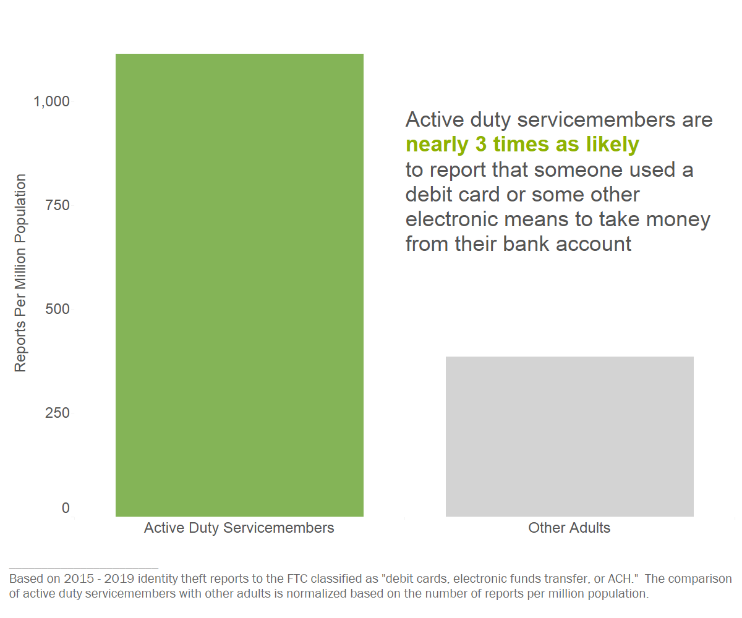

Identity theft causing outsized harm to our troops rcuster May 21, 2020 | 11:00AM Identity theft causing outsized harm to our troops By Emma Fletcher Our men and women in uniform take on unique hardships when they choose to serve. Identity theft shouldn’t be one of them. But the FTC’s Consumer Sentinel Network database shows that active duty servicemembers file reports about many forms of identity theft – and related problems with debt collection and credit reporting – at much higher rates than non-military consumers. Five years of identity theft data reported to the FTC on IdentityTheft.gov show that active duty servicemembers are 76% more likely than other adults to report that an identity thief misused an existing account, such as a bank account or credit card.1 Most notably, they are nearly three times as likely to report that someone used a debit card or some other electronic means to take money directly from their bank account.2 This finding suggests that servicemembers are experiencing highly disproportionate instances of theft from their financial accounts compared to the general population. That’s not all. They also are 22% more likely to report that their stolen information was misused to open a new account,3 especially new credit card accounts. Recovering from identity theft can be a challenge in the best of circumstances, and it can take months or even years to untangle the mess when not caught quickly. But keeping a close eye on credit reports, which can help someone spot early warning signs, can be difficult for active duty troops. They report that creditors often send notices to old addresses, which may delay their ability to act on warning signs, such as bills from unknown creditors or unexpected credit card charges.4 In fact, one-fifth of active duty servicemember reports indicate that they have already experienced two or more types of identity theft. However, many active duty servicemembers report that they have taken protective steps. Nearly half tell us they have reviewed their credit reports and 40% say they have a fraud alert in place when they report identity theft. What the data doesn’t tell us is how many took these steps before learning of a problem. Securing personal information may also present special challenges for active duty troops. Nearly 14% of their reports indicate that a family member or someone they know stole their identity, compared to just 7% of other adults who report. Reports suggest that this often happens when people have access to important documents or financial records left behind during military assignments. When identity theft happens, credit problems and collection calls often follow. Based on data provided by the Consumer Financial Protection Bureau, active duty servicemembers report problems with debt collectors and credit bureaus at more than twice the rate of other adults.5 More than 40% of the debt collection reports indicate that the debt was caused by identity theft, and more than 40% of the reports about credit bureaus indicate that information on a credit report belongs to someone else.6 And many say they worry that these problems could put their security clearances and their military careers at risk. Frequent moves and overseas service are also associated with other kinds of credit reporting complaints. Military personnel have protections that can allow them to cancel housing contracts, vehicle leases, and some other accounts before they ship out, but reports show this doesn’t always go smoothly. Often, people learn of a problem only when they spot a ding (or worse) on their credit reports. MilitaryConsumer.gov is a resource for servicemembers, veterans, and their families to avoid scams and manage money. Here are a few things you can do now to protect yourself: Check your bank account regularly. Report a lost or stolen debit card or unauthorized transactions immediately. Your bank may have a service to alert you to every transaction or transactions over a certain amount. To prevent someone from misusing your debit or credit cards, many banks will let you temporarily lock or freeze your card online or through their mobile app. You can quickly and easily unlock the card at any time the same way. Don’t give out authentication information – including PIN numbers or verification codes – to anyone who calls, emails, or texts you. If you didn’t initiate the contact, you can bet it’s a scam. Sign up for free credit monitoring, available to active duty servicemembers, to get notifications of activity on your credit reports. Put an active duty alert on your credit reports if you’re deploying. Alerts last a year (you can renew) and require creditors to take steps to verify your identity before granting credit in your name. Even if you’re not deploying, consider placing a fraud alert if you suspect identity theft. Consider a credit freeze if you want a bit more protection and if it fits your situation. Know your rights under the Servicemembers Civil Relief Act. Talk with a Personal Financial Manager or your military legal assistance office to learn more. Go to IdentityTheft.gov to report and get a plan to recover from identity theft. 1 This and other identity theft figures are based on 2015-2019 identity theft reports to the FTC classified as the following theft subtypes: checking\savings account – existing, credit card – existing, debit cards, electronic funds transfer, or ACH, ITAC – account takeover, landline telephone – existing accounts, mobile telephone – existing accounts, utilities – existing accounts. The comparison of active duty servicemembers with other adults is normalized based on the number of reports per million population. The population figure for other adults was obtained from the U.S. Census Bureau 2018 American Community Survey 1-year demographic and housing estimates. The population figure for active duty servicemembers was obtained from the Defense Manpower Data Center December 31, 2019 file titled Number of Military and DoD Appropriated Fund (APF) Civilian Personnel Permanently Assigned. The FTC received 13,467 identity theft reports from 2015 through 2019 that indicated the consumer was an active duty servicemember. 2 This figure is based on 2015-2019 identity theft reports to the FTC classified as debit cards, electronic funds transfer, or ACH. The comparison of active duty servicemembers to other adults is normalized based on the number of reports per million population as described in endnote 1. 3 This figure is based on 2015-2019 identity theft reports to the FTC classified as the following theft subtypes: checking\savings account – new, credit card – new, ITAC – new account, landline telephone – new accounts, mobile telephone – new accounts, utilities – new accounts. The comparison of active duty servicemembers to other adults is normalized based on the number of reports per million population as described in endnote 1. 4 About 12% of the 1,842 2018 and 2019 debt collection complaints from active duty servicemembers in Sentinel that were contributed by the Consumer Financial Protection Bureau (CFPB) cited problems receiving proper written notification of a debt, often due to relocation. 5 This figure is based on 2018 and 2019 reports in Sentinel contributed by the CFPB and classified as credit bureaus, creditor debt collection, and third party debt collection. The comparison of active duty servicemembers to other adults is normalized based on the number of reports per million population as described in endnote 1. 6 This figure is based on 2018 and 2019 reports in Sentinel contributed by the CFPB and classified as creditor debt collection, third party debt collection, and credit bureaus. Nearly 43% of the 1,842 reports from active duty service members about debt collection indicate the debt is the result of identity theft, and nearly 43% of the 3,301 reports about credit bureaus indicate the information belongs to someone else.

FTC Data Spotlight Blog

We are an ethical website cyber security team and we perform security assessments to protect our clients.